Professional accountants’ role in sustainability reporting has never been so paramount. Our work in 2023 focused on supporting both the European Sustainability Reporting Standards (ESRS) and the International Sustainability Standards Board’s (ISSB) standards.

We engaged in every step of the development of the first set of 12 ESRS, including contributing to the European Commission’s draft delegated act with these standards. We organised the event Supporting high-quality ESRS implementation with EFRAG focusing on the high quality ESRS implementation. We also provided ideas on the rationalisation of reporting requirements and postponement of ESRS sector deadlines.

On international level, we responded to the ISSB’s agenda consultation and suggested they equally prioritise implementation support and the development of more topical standards.

Assurance plays a key role to enhance trust in the reported information. This is why we believe global assurance standards for sustainability will help the consistency, comparability and reliability of information to meet users’ needs. We welcomed IAASB’s work on a stand-alone, profession-agnostic and principles-based standard that could become a global baseline for sustainability assurance engagements. Our comment letter highlighted how the draft standard (ISSA 5000) could better respond to public interest issues related to sustainability assurance.

In addition, we held several events (e.g. Preparing for high-quality sustainability assurance engagements and Towards digital corporate reporting with CSRD) to exchange on these key topics. We also continued to share Member Bodies’ best practices on sustainability education on our dedicated online hub.

Companies need to embark into a transformative journey to truly embrace sustainability. Good corporate governance is crucial to initiate and steer those radical changes.

Accountancy Europe continued to support an effective outcome for the Corporate Sustainability Due Diligence Directive’s (CSDDD) legislative process throughout 2023. We organised the debate CSDDD: priorities for EU final negotiations with the EP intergroup on sustainable, long-term investments & competitive European industry at the European Parliament to discuss the trilogue negotiations. This was held in cooperation with the European Sustainable Investment Forum (Eurosif), Frank Bold, ShareAction and the World Benchmarking Alliance.

As part of our ESG governance agenda, we published ESG governance: questions boards should ask to lead the sustainability transition with the European Confederation of Directors’ Associations (ecoDa) and the European Confederation of Institutes of Internal Auditing (ECIIA). The paper aimed to help boards embed sustainability into company strategy and business models, and to ensure that proper governance supports this.

Finally, we issued the paper Multi-stakeholder analysis of corporate failures which discusses how companies could be more resilient against emerging risks and proposes ideas to make the corporate governance ecosystem risk-proof.

All parties in the corporate reporting ecosystem have a common objective: to improve the quality of reporting. Consistent, high-quality audits is an essential element to achieving this goal. Accountancy Europe continued to work on audit-related issues that are relevant to policymakers and stakeholders. This year, our publications looked into the Dynamics influencing auditor choice in the Public Interest Entity (PIE) market and Key factors to develop and use audit quality indicators (AQIs).

Drawing from several projects across our work programmes, we organised a full day conference Shaping a future-proof corporate ecosystem that brought together a wide range of stakeholders including supervisors, external and internal auditors, and company directors. Together, participants and speakers discussed solutions on how to: enhance quality of corporate reporting ii) bring greater resilience in the corporate sector.

International standards on auditing and the Code of Ethics are the cornerstones of our profession. We are glad to contribute to their evolution as a response to changing circumstances and emerging needs. This year we responded to several IAASB and PCAOB consultations.

In 2023, interest in SMEs and sustainability surged. We engaged on this topic throughout the year with a wide set of stakeholders. For instance, we addressed accountants’ role in SME sustainability at an Enterprise Europe Network (EEN) meeting, and discussed the CSRD’s impact on SMEs with the European Association of Chemical Distributors (FECC) and the European Association of Guarantee Institutions (AECM). We also presented our views on sustainable finance and SMEs at a European Microfinance Network (EMN) workshop and twice at the OECD.

In addition, we issued two sustainability-related publications: 5-step starting guide to a sustainable transition for SMEs and 5 Reasons why sustainability matters for SMEs. They were co-branded with Ecopreneur.eu, the European sustainable business federation, and supported by the European Association of Cooperative Banks (EACB).

EU policymakers continued to recognise Accountancy Europe’s importance on SME policies. We engaged with DG TAXUD on the Head Office Tax System for SMEs proposal, participated in a VAT in the digital age (ViDA) workshop at the EP, and met MEPs to discuss the Late Payment Regulation to propose changes that benefit SMEs. We also spoke at the EC’s annual SME Assembly in Bilbao, where we emphasised accountants’ role in identifying early warning signs.

In 2023, we pursued our work on financial reporting and contributed to several International Accounting Standards Board (IASB) and EFRAG projects.

We commented on the IASB’s Exposure Draft on amendments to the classification and measurement of financial instruments and discussed the upcoming Exposure Draft on Dynamic Risk Management. We also provided our recommendations on EFRAG’s discussion paper: Accounting for Variable Considerations. These discussions were also an opportunity to brainstorm on practical issues for future comment letters.

Finally, we exchanged with our experts on the findings of ESMA’s Corporate Reporting and Enforcement Reports as well as their implications on the profession. Our discussions also included at Accountancy Europe to address the situation and aim to raise awareness among members of the enforcement process at national and European levels.

Accountancy Europe included attractiveness of the accountancy profession as a strategic priority for 2023-2024. We have put in place several initiatives to i) initiate the discussion with Member Bodies, ii) promote the profession’s attractiveness to the outside world, especially younger people, and iii) understand the problem by collecting data on the profession’s development.

For example, we discussed global and local solutions to enhance the attractiveness of the profession at the Institute for Tax Advisors and Accountants (ITTA)’s annual conference. We

Throughout the year, as well as the importance of work-life balance during Members’s Assemblies and a Members’ only webinar. We set up a dedicated webpage where Member can share national initiatives on the challenge of the profession’s attractiveness. In addition, our publications now specifically refer to the links between the topic in question and attractiveness.

This initial work has allowed the team to better prepare for the year to come and give further shape to our strategy on this existential issue for the profession.

The new AML rules will bring significant changes for the accountancy profession. We held a Members’ only webinar to discuss how the new legal requirements will affect the profession and help accountants understand and prepare for the expected changes.

In addition, we shared Member Bodies’ feedback with the EC on ensuring a level playing field in the 6th AML Directive. Our outreach had a successful outcome in the final agreed text.

Accountancy Europe continues its membership of the IPSASB CAG, through which we have long encouraged the IPSASB to promote sustainability reporting in the public sector.

We teamed up with IPSASB and IFAC for the Equipping the Public Sector for Sustainability Action event and to support IPSASB in their Brussels outreach event on their next 5-year strategy and workplan. We also responded to the IPSASB’s ED 83 Reporting sustainability program information.

Promoting accruals accounting in the public sector, we met with MEP Hohlmeier and with the DG ECFIN to discuss proposed amendments to the budgetary framework for Member States.

Professional ethics are the bedrock of the accountancy profession. Ethical behaviour in business is fundamental for public trust and confidence. We integrate this ethical dimension in all our work and contribute to the evolution of global standard setting in this area. This year we responded to the International Ethics Standards Board for Accountants’ (IESBA) consultation on its 2024-2027 Strategy and Work Plan. We also responded to IESBA’s proposed revisions to the Code of Ethics addressing tax planning and related services.

Accountancy Europe continues to be an important stakeholder on tax for EU legislators, having spoken at EP hearings on VAT in the Digital Age and Tackling the role of tax Enablers. We’ve also met several times with MEPs and DG TAXUD on important tax files.

We published factsheets covering the OECD’s Pillar 2, VAT in the Digital Age, the Head Office Tax System, proposed amendments to EU transfer pricing and the proposed BEFIT legislation. We also responded to the public consultations to the EC’s Head Office Tax system legislative proposal.

Our banking experts came together several times in 2023 to discuss strategic issues for the profession on financial services. The group also exchanged views with European authorities, institutions and associations focused on the financial sector such as the European Banking Authority and the European Central Bank. We had the opportunity to share the profession’s views on regulatory and prudential matters. We also exchanged on how the European banking system deals with the macroeconomic and geopolitical uncertainties and the impact on auditors’ work.

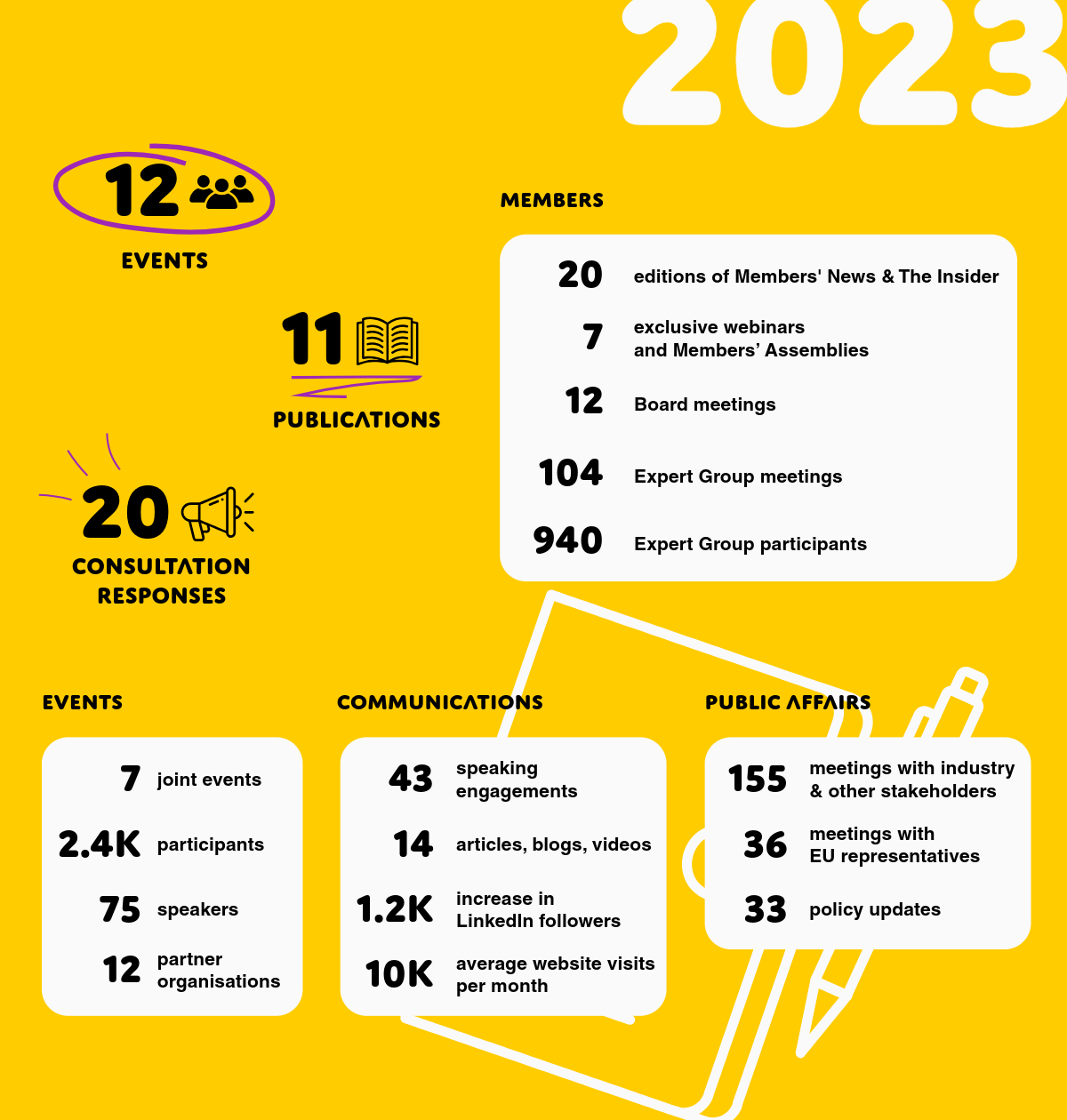

Our Member Bodies send experts from across Europe to Expert Groups that contribute to our projects. Together, our Members also form our highest governance body: the Members’ Assembly. The Members’ Assembly provides high level guidance to our Board on strategy; it also appoints and supervises the Board.

We connected with Members through 7 Members only meetings focusing on governance and strategic technical matters. A highlight of the year, our Members’ Engagement Day focused on the 3 topics driving the year’s agenda: sustainability, corporate governance and the attractiveness of the profession. Those who could travel greatly enjoyed the opportunity to reconnect in person.

IWP, KSW

Institute of Austrian Certified Public Accountants, The Austrian Chamber of Tax Advisors and Auditors

ITAA, IRE/IBR

Belgian Institute for Tax Advisors & Accountants, Institute of Registered Auditors

SRR FBiH, SRRRS

Union of Accountants, Auditors and Financial Workers of the Federation of Bosnia and Herzegovina, Association of Accountants and Auditors of the Republic of Srpska

ICPAB

Institute of Certified Public Accountants

HRK

Croatian Audit Chamber

ICPAC

Institute of Certified Public Accountants of Cyprus

KACR

Chamber of Auditors of the Czech Republic

FSR

FSR -Danish Auditors

EAA

Estonian Auditors' Association

ST

Finnish Association of Authorised Public Accountants

CNCC, IFEC, CNOEC France

Institute of Statutory Auditors, The French National Institute of Accountants and Auditors, The Order of Certified Accountants

WPK, IDW

Chamber of Public Accountants, Institute of Public Auditors in Germany

SOEL

Institute of Certified Public Accountants of Greece

MKVK

Chamber of Hungarian Auditors

FLE

Institute of State Authorised Public Accountants in Iceland

CAI

Chartered Accountants Ireland

CNDCEC

National Board of Professional Chartered Accountants

LRGA, LZRA

Association of Accountants of the Republic of Latvia, Latvian Association of Certified Auditors

LAAA, LAR

Lithuanian Association of Accountants and Auditors, Lithuanian Chamber of Auditors

IRE, OEC Luxembourg

Institute of Registered Auditors, Order of Chartered Accountants

MIA

The Malta Institute of Accountants

ISRCG

Institute of Certified Accountants of Montenegro

NBA

The Royal Netherlands Institute of Chartered Accountants

DNR

The Norwegian Institute of Public Accountants

OROC

Institute of Statutory Auditors

CAFR, CECCAR

Chamber of Financial Auditors of Romania, The Body of Expert and Licensed Accountants of Romania

SRRS

Serbian Association of Accountants and Auditors

SKAU

Slovak Chamber of Auditors

SIZR

Slovenian Institute of Auditors

ICJCE

Institute of Chartered Accountants of Spain

FAR

FAR

EXPERTsuisse

EXPERTsuisse

TÜRMOB

Union of Chambers of Certified Public Accountants of Türkiye

ACCA, CIMA, CIPFA, ICAEW, ICAS

Association of Chartered Certified Accountants, Chartered Institute of Management Accountants, The Chartered Institute of Public Finance and Accountancy, Institute of Chartered Accountants in England and Wales, Institute of Chartered Accountants of Scotland

Austria

IWP

Institute of Austrian Certified Public Accountants View website

KSW

The Austrian Chamber of Tax Advisors and Auditors View website

Belgium

ITAA

Belgian Institute for Tax Advisors & Accountants View website

IRE/IBR

Institute of Registered Auditors View website

Bosnia Herzegovina

SRR FBiH

Union of Accountants, Auditors and Financial Workers of the Federation of Bosnia and Herzegovina View website

SRRRS

Association of Accountants and Auditors of the Republic of Srpska View website

Bulgaria

ICPAB

Institute of Certified Public Accountants View website

Croatia

HRK

Croatian Audit Chamber View website

Cyprus

ICPAC

Institute of Certified Public Accountants of Cyprus View website

Czech Republic

KACR

Chamber of Auditors of the Czech Republic View website

Denmark

FSR

FSR -Danish Auditors View website

Estonia

EAA

Estonian Auditors' Association View website

Finland

ST

Finnish Association of Authorised Public Accountants View website

France

CNCC

Institute of Statutory Auditors View website

IFEC

The French National Institute of Accountants and Auditors View website

CNOEC France

The Order of Certified Accountants View website

Germany

WPK

Chamber of Public Accountants View website

IDW

Institute of Public Auditors in Germany View website

Greece

SOEL

Institute of Certified Public Accountants of Greece View website

Hungary

MKVK

Chamber of Hungarian Auditors View website

Iceland

FLE

Institute of State Authorised Public Accountants in Iceland View website

Ireland

CAI

Chartered Accountants Ireland View website

CNDCEC

National Board of Professional Chartered Accountants View website

Latvia

LRGA

Association of Accountants of the Republic of Latvia View website

LZRA

Latvian Association of Certified Auditors View website

Lithuania

LAAA

Lithuanian Association of Accountants and Auditors View website

LAR

Lithuanian Chamber of Auditors View website

Luxembourg

IRE

Institute of Registered Auditors View website

OEC Luxembourg

Order of Chartered Accountants View website

MIA

The Malta Institute of Accountants View website

Montenegro

ISRCG

Institute of Certified Accountants of Montenegro View website

Netherlands

NBA

The Royal Netherlands Institute of Chartered Accountants View website

Norway

DNR

The Norwegian Institute of Public Accountants View website

Portugal

OROC

Institute of Statutory Auditors View website

Romania

CAFR

Chamber of Financial Auditors of Romania View website

CECCAR

The Body of Expert and Licensed Accountants of Romania View website

Serbia

SRRS

Serbian Association of Accountants and Auditors View website

Slovak Republic

SKAU

Slovak Chamber of Auditors View website

Slovenia

SIZR

Slovenian Institute of Auditors View website

ICJCE

Institute of Chartered Accountants of Spain View website

Sweden

FAR

FAR View website

Switzerland

EXPERTsuisse

EXPERTsuisse View website

Türkiye

TÜRMOB

Union of Chambers of Certified Public Accountants of Türkiye View website

United Kingdom

ACCA

Association of Chartered Certified Accountants View website

CIMA

Chartered Institute of Management Accountants View website

CIPFA

The Chartered Institute of Public Finance and Accountancy View website

ICAEW

Institute of Chartered Accountants in England and Wales View website

ICAS

Institute of Chartered Accountants of Scotland View website

Composed of practitioners who have area-specific knowledge and skills, Expert Groups are at the heart of Accountancy Europe’s daily work. They act as a sounding board and source of expertise. Each group is led by a Chair. Some groups also have Vice-Chairs, who lead work on specific topics aligned with the current strategy and short-term objectives.

David Herbinet

Jens Poll

Olivier Schérer

Wim Bartels

Michael Stewart

Angela Foyle

Gregory Joos

IAASB & PCAOB Working Party

IFRS 9 Task Force

Paolo Ratti

Liesbet Haustermans

Peter Welch

Luca Bosco

Christine Weinzierl

Based on our strategy, the Board supervises and guides our work. The Board acts in the collective interest of Accountancy Europe and of the whole European profession, independently from any national or sectoral interest. The Board has 12 members, including two executive members, from 10 countries and is chaired by the President. The President represents Accountancy Europe for a two-year term.

President

Deputy-President

Vice-President

Vice-President

Vice-President

Vice-President

Vice-President & Treasurer

Vice-President

Vice-President

Vice-President

Chief Executive

Deputy Chief Executive

Our Team executes the strategy set by the Board. It manages projects and steers the work of the Expert Groups in cooperation with their Chairs and Vice-Chairs.

Consisting of people with diverse nationalities and professional backgrounds based in Brussels, the Team is led by the Chief Executive who manages and represents Accountancy Europe.

Senior Manager, Head of Advocacy & Policy

Senior Manager, Head of Reporting

Senior Manager, Head of Governance, Membership & Administration

Manager, Head of EU Audit Regulation

Manager, Professional Expertise

Director, Communications & Events

Intern, Communications

Senior Advisor, Advocacy & Policy

Advisor, Advocacy & Policy

Director, Professional Services

Executive Assistant

Director, Strategy Coordination & Political Affairs

Advisor, Communications

Manager, Office & Finance

Administrative Officer

Manager, Head of Communications

Administrative Officer

Manager, Head of Sustainability

Senior Manager, Head of Assurance

Accountancy Europe’s annual statutory accounts are audited and prepared in accordance with the requirements of Belgian legislation. You may consult the annual accounts of Accountancy Europe on the National Bank of Belgium’s website: https://cri.nbb.be/bc9/

Members’ contributions account for 94% and ACE events revenue for 6% of Accountancy Europe’s income.

*Note: These figures are estimates at the date of printing; our financial statements are approved in June.