26 September 2024 — Publication

Simplifying and accelerating WHT repayments

The European Union has recently passed the FASTER Directive that aims to simplify and speed up the repayment of excess withholding tax (WHT) levied by some Member States on dividends paid to non-resident equity holders.

This legislation allows for the deduction of WHT at source and / or the faster repayment of withheld tax. It is predicated on key financial institutions’ increased involvement and introduces the Certified Financial Intermediary. The new law also requires Member States to establish systems to issue digital tax residence certificates, which will facilitate WHT repayments and could streamline other future cross-border tax issues.

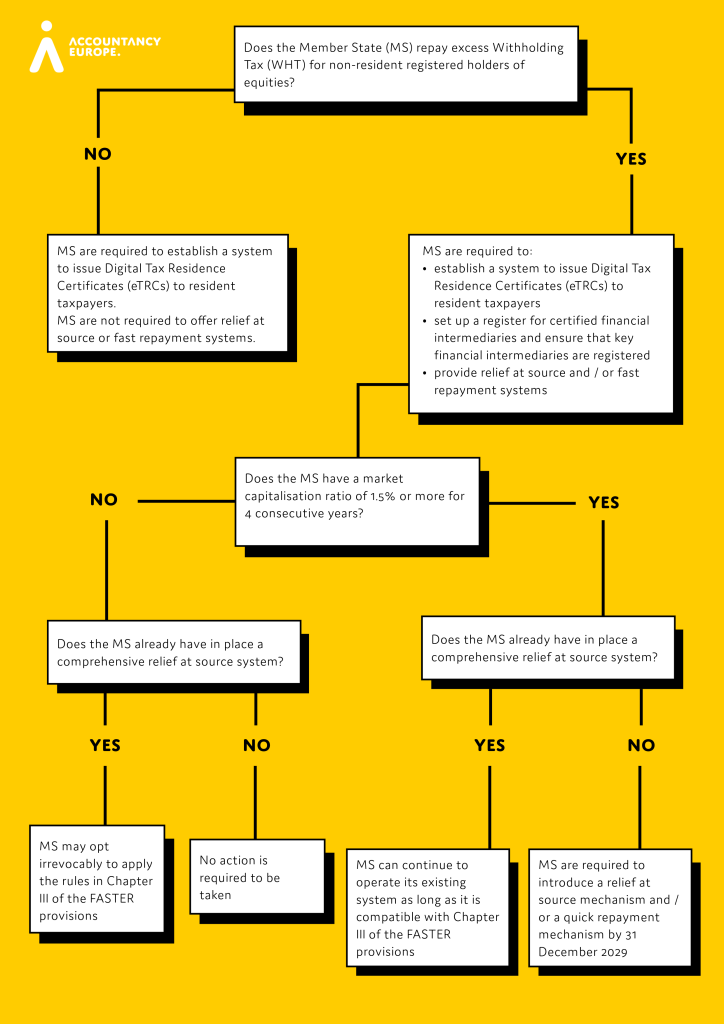

The legislation is complex as it takes into account national specificities. This publication provides a flowchart of obligations and options affecting Member States.

FASTER was published in the EU’s Official Journal on 10 January 2025. This means that the legislation is now officially EU law, and its provisions will start applying from the dates set out in the directive.