7 June 2024 — Publication

Summary of views from Accountancy Europe

The European Sustainability Reporting Standards (ESRS) have been effective since 1 January 2024 for the first companies in the Corporate Sustainability Reporting Directive’s (CSRD) scope. The ESRS introduce a new reporting framework in Europe, and include many new concepts which stakeholders may find challenging.

Accountancy Europe has contributed to every step of the ESRS’ development and finalisation, including to EFRAG’s guidance. In this series of publications, we summarise the ESRS’ provisions on these concepts and share our views on ESRS aspects that merit further guidance and clarification. To provide background information for our views, we have summarised the existing ESRS’ provisions on these concepts and where applicable, incorporated EFRAG’s guidelines. We have not interpreted or provided guidance on these matters.

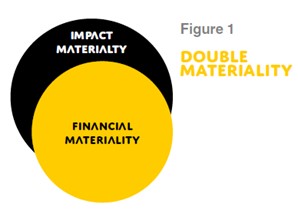

For ESRS’ purpose, material information needs to meet the criteria of double materiality, which is the union of impact materiality and financial materiality (see Figure 11). A sustainability matter can be material from an impact perspective or a financial perspective, or both.

A materiality assessment process will help identify the material impacts, risks and opportunities (IROs) as well as the respective material information to disclose. IROs will need to be assessed for both the company’s own operations and the value chain as well as for the short-, medium- and long-term.

The general rule in ESRS is that the (double) materiality assessment informs the information to report. However, the following are exceptions to this general rule:

ESRS 2 Appendix C lists all the disclosure requirements in all ESRS, including IRO-1 ones.

ESRS 2 Appendix B lists all the EU legislation-related datapoints.

EFRAG issued the non-authoritative IG1 Materiality Assessment Implementation Guidance (EFRAG’s MA IG) to support application.

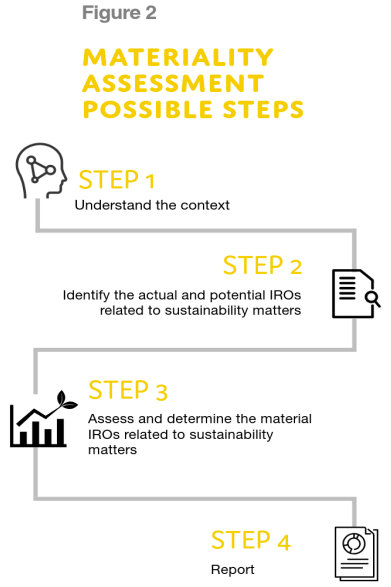

ESRS do not mandate a specific process to follow as it will vary depending on companies’ respective characteristics. However, companies can draw inspiration from the list of sustainability matters (see paragraph AR16 of Appendix A in ESRS 1) or even the good practices shared in EFRAG’s MA IG (see Figure 2 ).

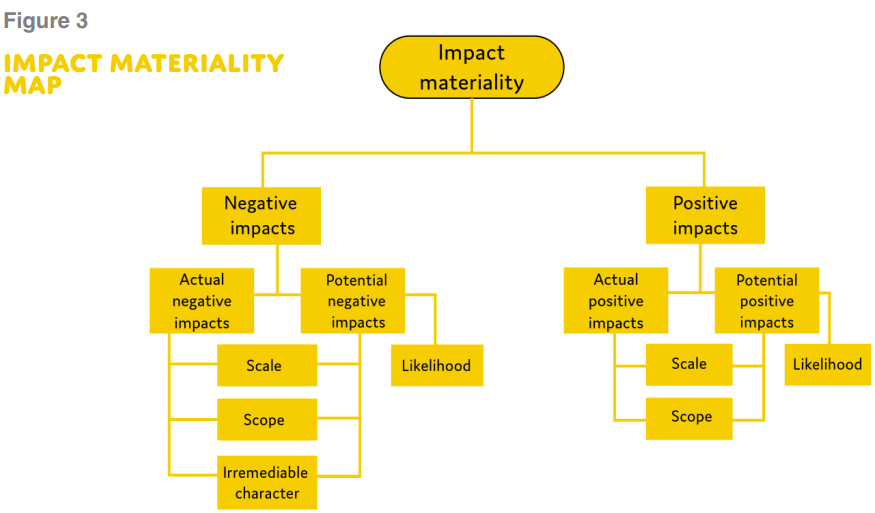

In assessing IROs from the impact perspective, the company looks for actual or potential, positive or negative impacts in the short-, medium- and long-term.

To make that assessment, there are 4 possible combinations, composed of the respective elements/criteria of scale2, scope3, irremediable character4 (together referred to as “severity”) and likelihood (see Figure 3). The company assesses whether and how it meets each of these criteria by setting its own thresholds for them.

In assessing from the financial perspective, the entity looks for sustainability risks and opportunities that over the short-, medium- and long-term trigger financial effects to the entity in terms of financial performance, financial position, cash flows, access to finance and cost of capital. Information is considered material from a financial perspective if it could influence the decisions of the primary users of financial reports (e.g., in providing resources to the entity).

We welcome the ESRS and EFRAG’s MA IG and appreciate that many of our suggestions for improvements have been taken into account. However, we believe that the following key matters need further clarification and interpretation by the European Commission (EC), as well as guidance, which could be provided by EFRAG.

The company will need to determine material IROs in the upstream and downstream value chain in addition to its own operations. We appreciate EFRAG’s IG2 Value Chain Implementation Guidance includes this matter, but, call for further guidance and examples on incorporating the value chain in the materiality assessment and determining how far to go in the value chain for this assesment.

EFRAG’s guidance on this topic is very useful, particularly as the ESRS do not address groups or consolidation in details. However, more examples would help to further illustrate the guidance. In addition, it is important to clarify and provide more guidance and examples on consolidating, aggregating and disaggregating IROs as these elements remain open to interpretation.

Experience in reporting on social matters is relatively new when compared to reporting on environmental topics. Assessing double materiality for these topics, both for own operations and value chain is also new, particularly when adding human rights considerations to the elements of the assessment. Guidance and examples on this matter could help stakeholders align their practices and expectations.

More guidance and examples on identifying, assessing and reporting on material risks and opportunities, developed in collaboration with the International Sustainability Standards Board (ISSB) (see below), would be useful. Particularly, it is important to:

Financial institutions, conglomerates and multinational enterprises have very complex own operations and value chains. Without clear boundaries, these companies’ materiality assesements may include the whole world. We welcome further guidance for these industries and look forward to the sector-specific standards which could help ensure consistency and comparability but also align expectations.

The ESRS have been aligned with the ISSB’s standards as well as the Global Reporting Initiative’s (GRI) standards for their respective aspects. However, we regret such collaboration did not take place for this guidance. EFRAG and the EC, ISSB and GRI should continuously work together in aligning practices in addition to standards as it will minimise compliance costs and lead to efficiencies in processes and reporting.

DISCLAIMER: Accountancy Europe makes every effort to ensure, but cannot guarantee, that the information in this publication is accurate and we cannot accept any liability in relation to this information. We encourage dissemination of this publication, if we are acknowledged as the source of the material and there is a hyperlink that refers to our original content. If you would like to reproduce or translate this publication, please send a request to [email protected].

Scroll up to download this publication in PDF.

Published in this series:

Our consultation responses: