8 November 2024 — Publication

Summary of views from Accountancy Europe

The European Sustainability Reporting Standards (ESRS) have been effective since 1 January 2024 for the first wave of companies within the Corporate Sustainability Reporting Directive’s (CSRD) scope. The ESRS introduce a new sustainability reporting framework in Europe, and include many new concepts that stakeholders may find challenging.

Accountancy Europe supports both European and international sustainability standards. This paper aims to share our views on the interoperability of ESRS and the main international sustainability reporting standards: the International Sustainability Standards Board’s (ISSB) IFRS Sustainability Disclosure Standards (IFRS SDS) and the Global Reporting Initiative (GRI) standards. We have summarised the main features of the ESRS, ISSB and GRI standards as well as the work done in light of interoperability to provide background for our views.

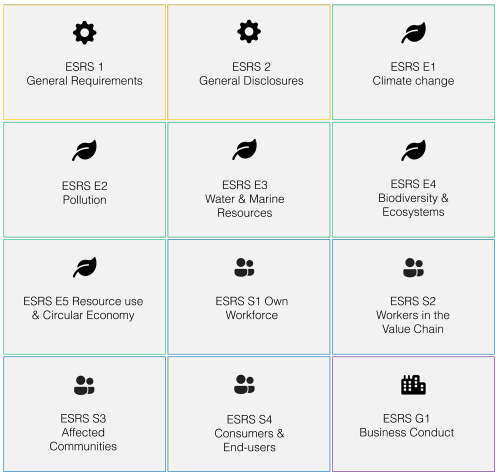

The ESRS consist of 12 sector-agnostic standards, covering a broad range of environmental, social and governance (ESG) topics (see Figure 1). There will also be sector-specific ESRS, which are currently under development at EFRAG.

The ESRS use a double materiality approach, which addresses both the impacts of a company on people or the environment over the short-, medium- and long-term, but also the impacts the latter have on the company’s financial performance and financial position over the same time periods (see ESRS perspectives: materiality assessment (2024) for more on double materiality). In line with the requirements of the CSRD (see textbox), the financial materiality lens’s definition is fully aligned with the ISSB’s definition of materiality, whereas the definition of the impact materiality lens is aligned with that of the GRI standards.

[…] To avoid unnecessary regulatory fragmentation that could have negative consequences for undertakings operating globally, Union sustainability reporting standards should contribute to the process of convergence of sustainability reporting standards at global level, by supporting the work of the International Sustainability Standards Board (ISSB).

Text extracted from the ESRS

As a result, the ESRS prescribe information that is useful to both broader stakeholders (the impact perspective) as well as investors, lenders and other creditors (the financial perspective). The users of information of the financial lens are the same as those determined in the ISSB standards.

The ISSB’s IFRS SDS consist of 2 standards addressing one topical standard: climate. The IFRS Foundation has also taken over the industry-specific SASB standards and is currently working on their internationalisation.

The ISSB standards use a financial materiality approach: they provide disclosures on how the environment and people affect the company’s financial performance and position in the short-, medium- and long-term. The IFRS SDS provide useful information to investors, lenders and other creditors.

The ISSB, the European Commission (EC) and EFRAG collaborated during the development of both the ESRS and the IFRS SDSs to align as much as possible. Ultimately, the ISSB, the EC and EFRAG confirmed a high degree of interoperability between the two sets of standards. The ISSB and EFRAG also published a joint Interoperability Guidance, primarily addressing their respective climate standard, illustrating the aligned disclosures and the differences left, which was welcomed by the EC.

There are 36 universal and topical GRI standards. In addition, GRI sector-standards are under development.

GRI standards have an impact materiality lens: the disclosures help provide information about a company’s impacts on people and the environment. Therefore, broader stakeholders are the main focus of GRI standards.

EFRAG collaborated closely with GRI when developing of the ESRS. The standards are well aligned, so much so that ESRS reporters are considered as “reporting with reference”1 to GRI standards. To facilitate “reporting with reference to GRI”, EFRAG and GRI are working on an interoperability index, which will show the high level of alignment between the standards (see the draft here).

Accountancy Europe welcomed EFRAG’s three non-authoritative ESRS implementation guidance documents which provide support to apply key concepts such as materiality assessment and value chain. We call for EFRAG, the ISSB and GRI to collaborate and ensure any upcoming guidance is aligned. Alignment of guidance in addition to that of the standards will promote homogeneous application of the respective standards.

Accountancy Europe supports sector-specific sustainability standards as they enhance relevance and comparability for the respective sectors. We strongly suggest EFRAG, ISSB and GRI to collaborate to produce interoperable sector-specific standards, starting with aligning the list of sectors classifications. In line with the requirements of the CSRD, we call on the EC and EFRAG to build on the existing GRI and SASB standards in the ESRS sector-standards development.

Accountancy Europe has welcomed EFRAG’s, the ISSB’s and GRI’s collaboration towards standards interoperability as it ultimately reduces the burden of reporting under different or new requirements when applying the three sets of standards. However, we recognise that there are limitations to alignment as preparers would still be reporting under different standards to meet different purposes. These limitations are averted by formally recognising equivalence2 of standards.

On the one hand, equivalence facilitates capital and trade flows, a direct benefit for all global companies, including European ones. On the other hand, not granting equivalence risks reciprocation from other jurisdictions whereby European companies would be burdened with extensive reporting obligations if they are asked to report under another local sustainability reporting framework in the foreign countries they operate in.

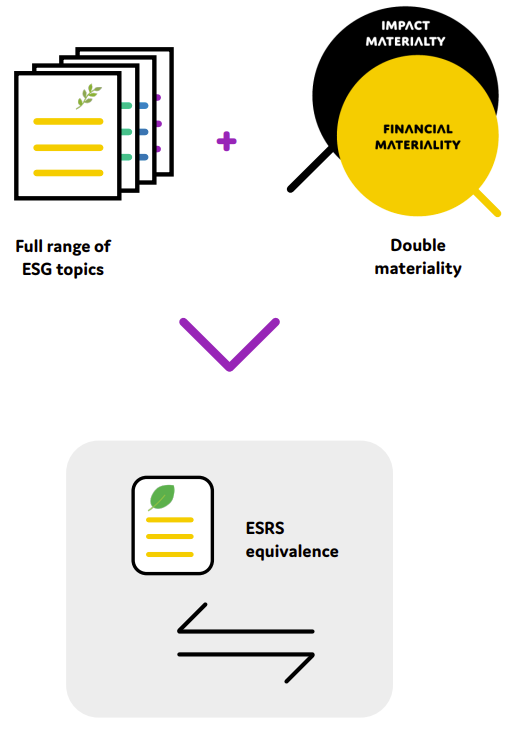

Under the CSRD, the EC may grant ESRS equivalence to non-EU companies that, in their local legislation, use a set of standards that meets two criteria (see Figure 2).

Accountancy Europe suggests that the EC considers the combination of GRI and IFRS SDS as equivalent to the ESRS. To this end, we suggest both the ISSB and GRI enhance their collaboration towards this goal.

In addition, we call for the ISSB to develop the full range of ESG standards, similarly to IFRS S2 Climate-related Disclosures, to be eligible for ESRS equivalence under the first criteria.

DISCLAIMER: Accountancy Europe makes every effort to ensure, but cannot guarantee, that the information in this publication is accurate and we cannot accept any liability in relation to this information. We encourage dissemination of this publication, if we are acknowledged as the source of the material and there is a hyperlink that refers to our original content. If you would like to reproduce or translate this publication, please send a request to [email protected].

Scroll up to download this publication in PDF.

Published in this series: