5 September 2018 — News

Tax: harnessing the potential of technology

Speakers: Benjamin Alarie (University of Toronto, Osler Chair in Business Law), Martin Scheid (German Research Centre for Artificial Intelligence, Researcher), Alan James (Avalara, Strategic Alliance Manager)

Session moderated by Eelco van der Enden (Chair of the Tax Policy Group, Accountancy Europe)

The tax breakout session focused on examples of technological innovations in the area of tax, and how these might impact the work of tax professionals and accountants in the future. It brought together three speakers, each presenting a separate innovation, to reflect on the future of tax professionals together with the audience.

The session was moderated by Eelco Van Der Enden, Chair of and Partner at PwC Netherlands. He opened the session by asking the room whether technology forces tax professionals to do things differently, or to do different things.

Ultimately, he reminded, technology and tax is a push-pull issue. Whilst technological innovations certainly shape the work of tax professionals, tax professionals can themselves also shape that change by adapting to a changing reality.

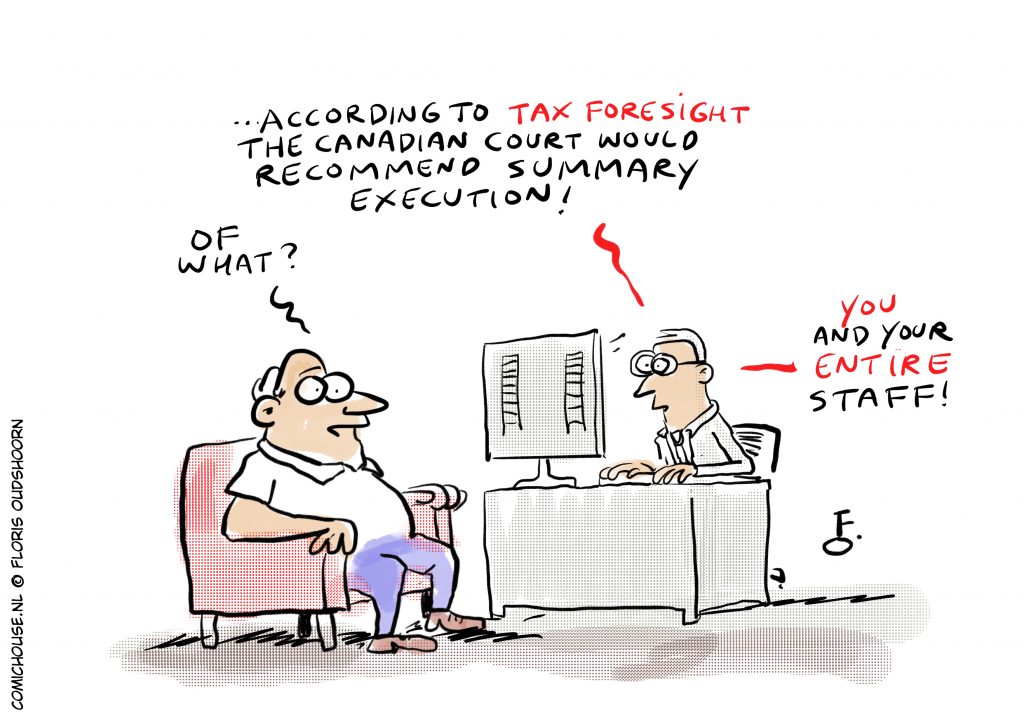

Benjamin Alarie, in his presentation, focused on Tax Foresight – a tax law software he has been working on at the University of Toronto. Tax Foresight provides an instant assessment of the likelihood of a court accepting or rejecting a particular tax arrangement. Its predictive skills are powered by a vast database of case-law and relevant legislation.

Professor Alarie then elaborates on the potential consequences of Tax Foresight and similar software. He noted that as a result of such software, the development of tax legislation is likely to accelerate, especially in terms of how the laws are applied and interpreted. Tax professionals, for their part, will not become obsolete. This kind of software merely provides a double-check on the professionals’ own analysis and intuitions.

Overall, this is likely to lead to happier clients, better advice, less negligence, and minimise negative tax consequences. It will also allow courts to focus their time and resources on the most controversial cases.

Martin Scheid, for his part, presented his work on the application of AI in organisations’ tax systems. The focus of his work has been to build up AI’s cognitive capabilities in specific tasks that are currently performed by humans. An AI can only perform well in such very specific tasks. Therefore, for the foreseeable future there is no risk of a generic AI taking over all processes.

Mr. Scheid’s team has focused on identifying within companies’ tax processes such areas where there are tangible limitations and challenges. Building up AI’s capabilities to perform such tangible, specific tasks enables tax professionals to save time and money.

Mr. Scheid’s job, specifically, is to analyse a company’s processes and structure. Tax departments in organisations are usually large with a lot of employees, and not everyone knows what the others do.

Some examples of AI application that Mr. Scheid brought up include a Chatbox that gathers information from the internet to answer tax questions (e.g. on tax rates of different countries). Moreover, his team is currently developing a translation prototype.

Another major field of work is anomaly detection. There is a lot of data in companies, but no one can realistically dwell through the data to identify anomalies or hidden patterns. Tax professionals need then to analyse the identified anomalies/patterns and give a professional assessment.

Mr. Scheid acknowledged that there may be transitional costs for companies to introduce their solutions. The first step is for organisations to build the knowledge of the various AI solutions and thus enable them to best adapt these solutions into the organisation in the most effective way. Ultimately however, human labour is the largest cost.

And finally, Alan James presented his organisation, Avalara – a tax software company. Avalara proposes various automatic reporting and digital data solutions, such as VATIlive which focuses on changes in VAT law around the world.

For many companies and tax professionals, it is pertinent to be aware of different laws, regulations, tax rates etc. that exist across the jurisdictions in which they or their clients operate. Thus, a large part of their job is to understand where the information that they need is in order to ensure that they remain compliant. Avalara’s solutions can pull this data from multiple systems.

Tax professionals, for their part, need to understand how different innovations (e.g. blockchains) can be used and are being used. Moreover, they need to bear in mind that these tools are available to tax authorities as well. Indeed, tax authorities are getting better at gathering this data.

Avalara, therefore, focuses on tax calculation and reporting to help companies ensure real-time that they understand their own data. Since tax authorities can see the data in real time, taxpayers also have to see and understand their data real-time.

In conclusion, Mr. James emphasised that technology is now a requirement to even have the basic starting blocks of tax compliance. Technology will take away some conventional forms of tax professionals’ work, but in turn it will also create new processes. Tax professionals need to be the guardians of a company’s tax system’s set-up. For this purpose, they must have ownership over the rules and information within an organisation, liaise more with systems and finance teams, and need a broad understanding of the data. In summary, the tax professional of the future must be more of a process-owner and IT expert than ever before.