17 February 2025 — Publication

Information paper

The IESBA has revised its Handbook of the International Code of Ethics for Professional Accountants to provide an ethical framework for tax planning and related services. This responds to a decade of public concern about ‘aggressive’ or ‘abusive’ tax planning activities of both businesses and individuals and the accountancy profession.

Our paper aims to set out the key requirements of the revisions through the lens of a typical workflow for a tax planning assignment. It also seeks to link the revisions to the legislative environment in Europe and to other statements in this arena – such as Accountancy Europe’s Accountants and Tax (2020).

Read the full paper in the “Download section”.

The revisions to the Code are an international response that aims to:

The revisions do not deal with illegal tax arrangements – professional accountants (hereafter “accountants”) should never knowingly become involved in illegal arrangements or activities. If they discover such activities, should consult their national requirements for reporting illegal acts.

As with other work undertaken by accountants, the starting point is that the accountant should adhere to the fundamental principles of the code: integrity, objectivity, professional competency and due care, confidentiality and professional behaviour.

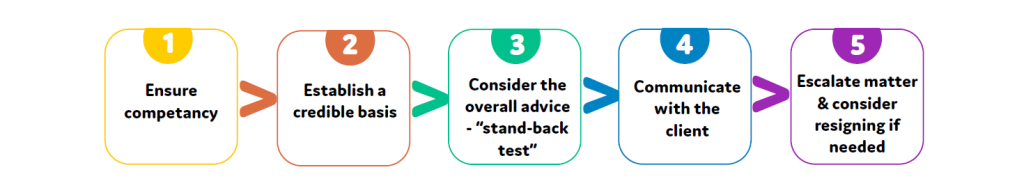

According to the revisions, the accountant should:

The accountant also needs to establish a “credible basis” in existing law and regulations for their advice, particularly for the tax advice or arrangement in the ‘grey zone’. This is the zone of uncertainty between arrangements that are obviously or explicitly allowed in law and those obviously or explicitly prohibited by law. Cross-border tax planning often create more grey zones due to differences in tax systems that create lacunas or possibilities for double taxation.

The accountant should perform a ‘stand back test’ after establishing the credible basis to view the arrangement from the viewpoint of sceptical third party. This enables to consider the arrangement’s broader consequences – including any reputational impact on the client, the accountant and the accountancy profession in general.

The accountant must communicate all the necessary information for the client to decide on the arrangement. The client must be aware of any uncertainties and potential consequences of the arrangement in order to make an informed decision. Written communication is recommended and documented at the time of the discussion.

Should disagreements arise as to whether an arrangement should proceed or not, the revisions contain detailed requirements and guidance about the steps to resolve the dispute – including withdrawing from the arrangement.

Where the services of a third party are incorporated into the arrangement, the same requirements also apply to the third party element. Where the accountant simply refers the client and the services are directly between the third party and client, the accountant should follow transparency requirements.

These revisions come into effect from 1 July 2025 and potentially impact tax professionals who are members of a professional accountancy body that is a member of IFAC’s or who are involved in transnational audits working for a member of The Forum of Firms.

The revisions contain separate sections for professional accountants in business and for professional accountants in public practice – the requirements for both are broadly similar.

Given’s Europe diverse regulatory environment, professional accountants should monitor pronouncements from their professional member body as to the impact of the Code. In some countries that have existing regulations, the Code revisions may supplement rather than replace the existing national requirements.