18 December 2025 — News

Insights, trends and resources

Private Equity refers to investment by third-party investors in private companies, aiming to generate returns through growth and operational improvements. Recent technological developments and market competition have led to increased PE investment in accountancy firms, attracted by their recurring revenues and growth potential. Third party investment in accountancy firms can come from different sources like staff or even family shareholding, long-term passive investors like pension funds, public listings, but currently private equity is the most prominent external investment in the sector.

This page provides an overview of our research on PE and third-party ownership more generally, including resources from our members and international bodies. Accountancy Europe has published two papers on the topic: Private equity investments in accountancy firms (June 2025) and Beyond private equity: third party ownership in the accountancy and audit sector (November 2025).

For more information on PE contact Endrin Bitraj: [email protected].

The accountancy profession has traditionally been characterised by partnership structures and organic growth. Firms have expanded through internal development, long-term client relationships, and reputational strength, rather than external investment or acquisition.

However, fast-moving technological developments, digitalisation and increasing competition have led firms to invest more heavily to remain competitive. At the same time, third party investors, and especially Private Equity (PE) investors have identified opportunities to invest in accountancy firms, attracted by their recurring revenues, cash flows and growth potential. There has been a notable increase in PE investments in the accountancy sector in recent years.

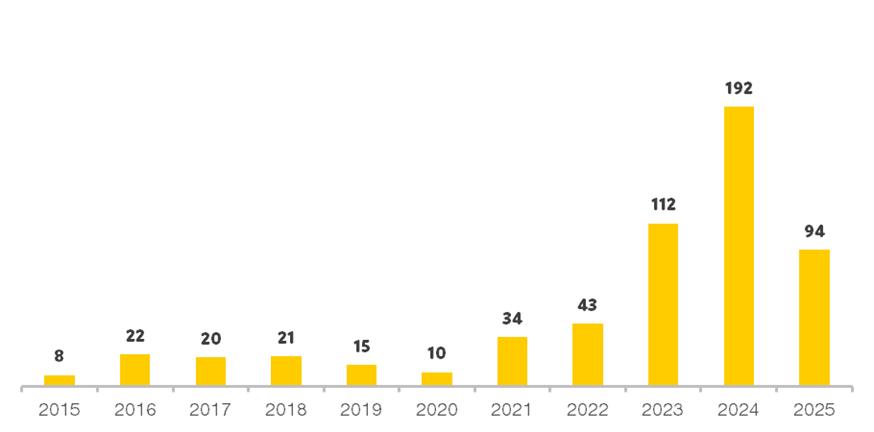

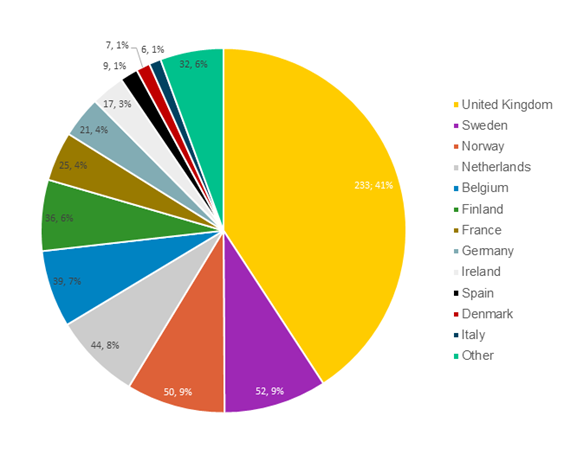

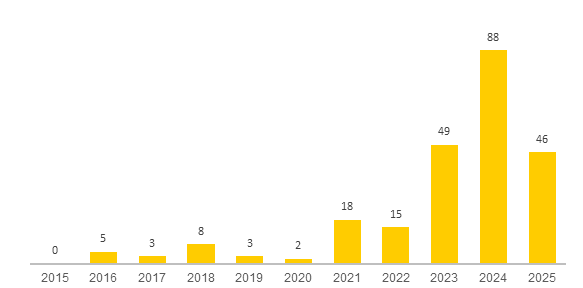

PE investment in the European accountancy sector has grown significantly over the past decade. Accountancy Europe gathered and analysed public data on PE investment transactions related to accountancy firms across Europe between 2015 and 2025.

From 2015 to 2020, PE activity in the sector was limited, with annual transactions ranging between 10 and 20.

In 2021 and 2022, activity remained at similar levels but saw a slight increase. A true inflection point occurred in 2023, when the number of PE transactions surged to over 100, nearly triple the previous year’s figure. This upward trajectory accelerated further in 2024, reaching around 200 transactions, almost 5 times the number recorded in 2022.

More than half of the deals (60%) involve primarily local accounting, tax, and advisory firms, while approximately 40% of the deals are in firms that also provide audit and assurance related services.

Over the past 10 years, around 150 PE firms have invested in the accountancy sector in Europe.

Trends and insights in European markets

Publication, 4 June 2025

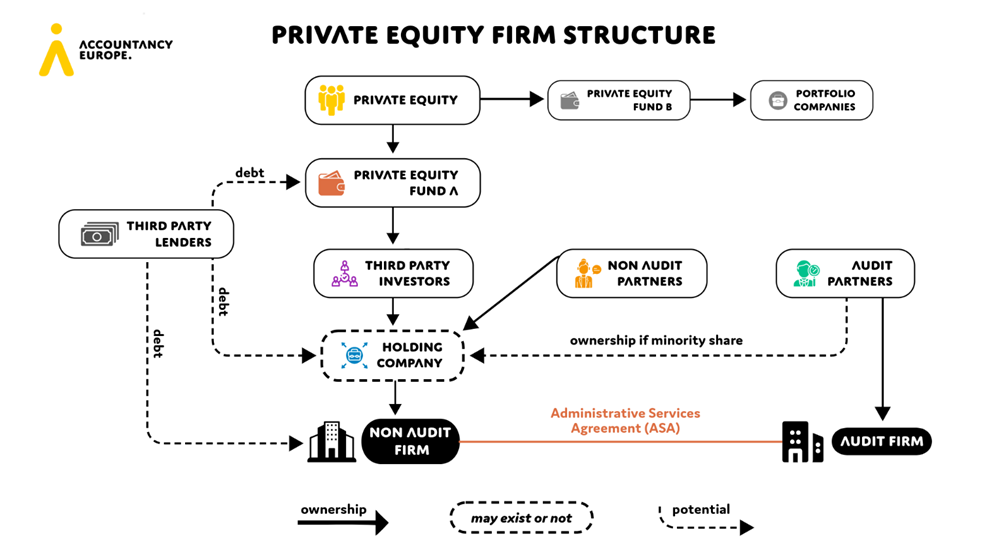

A PE fund ordinarily invests in an accountancy and audit firm that undergoes legal restructuring into two distinct entities: an audit firm and a non-audit firm. The non-audit firm usually provides professional services and resources to the audit firm under an administrative services agreement (ASA).

Risks and opportunities

Publication, 27 November 2025

Third party ownership is on the rise. Models such as PE are becoming more common across Europe and are reshaping the accountancy and audit profession. This trend comes with both opportunities and challenges, from growth and innovation to questions about independence, governance and audit quality. The debate is therefore not about whether third-party ownership will shape the future of the profession, but how its implications will be managed in practice.

Accountancy Europe does not take a position against or against third-party ownership. We bring together different perspectives so that policymakers, regulators, investors and the profession can have an informed and constructive dialogue.