The coronavirus pandemic has taken a heavy toll on European small and medium-sized businesses. That is why Accountancy Europe calls for the European Union and its national governments to move to a sustainable and resilient economy. We have learned this past year how significant SMEs are to Europe’s economy. We learned the hard way that having sustainable business models and strong risk management is key for SMEs to thrive in the long run. Improving SMEs’ resilience is an essential part of the Green Recovery that we need.

Accountants are SMEs’ trusted advisors. They are the first person SME owners turn to for advice. Accountants understand their clients’ underlying business. Their knowledge, skill set and ethical code of conduct enable them to provide strategic support and help SMEs thrive.

Each European accountant serves about 120 SMEs and gains extensive experience through their diverse SME client base. This is why SMEs can count on their accountants to help them create and run successful and resilient businesses.

We have identified 3 vital matters where accountants can provide crucial support in SMEs’ development. They can help SMEs make the transition cost efficient and worthy long-term investments.

SMEs are ready to play their part! But everyone (accountants, policy-makers and other relevant stakeholders in the SME ecosystem) needs to help them get there; because SMEs count on us all.

In the current environment, it is no longer a luxury for SMEs to move to sustainable business models. Society expects businesses to do better on matters such as environment and human rights. Investing in the sustainable transition is necessary to remain an attractive and resilient partner in the supply chain.

The sustainable transition needs SMEs to step up, and long-term resilient SME success cannot be achieved without the integration of sustainability considerations into their business strategies.

Accountants can help SMEs:

Have a look at our 3-step sustainability assessment for SMEs.

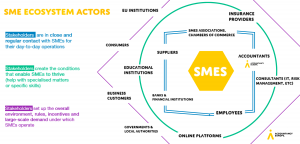

Dialogue between all SME ecosystem actors is crucial to find effective and holistic solutions to support SME through COVID.

Adequate financing is the number 1 need for EU SMEs to grow and innovate. The pandemic has reinforced the idea that SMEs should have better access to financing and diversify their funding sources which are key elements for their sustainability. Accountants have the knowledge and expertise to help SMEs:

Find out more about SMEs’ access to finance.

Rely on the experience and expertise of SME ecosystem actors to support the digital transition of small businesses!

The digital transition is essential for SMEs to remain competitive and grow. Along with all other actors of the ecosystem, accountants play a key role in SMEs’ digital transition and can:

Check our paper on SMEs’ digital future and how accountants can help them.