17 January 2025 — News

Accountancy Europe welcomes the European Commission’s efforts to reduce administrative and reporting burdens for European companies whilst not backtracking on policy objectives and targets. Reassessing requirements is an important aspect of good lawmaking, ensuring that only what is necessary remains in place to achieve underlying policy objectives. Accountancy Europe is committed to supporting the Commission’s and co-legislators’ work to achieve the burden reduction objectives, and is happy to propose practical solutions to this end.

The European Commission is now expected to launch an ‘omnibus package’ on 26 February 2025 which might, as suggested by President Ursula von der Leyen, focus at least on the ‘triangle’ of the Corporate Sustainability Reporting Directive (CSRD), Corporate Sustainability Due Diligence Directive (CSDDD) and the EU taxonomy. Whilst we support the burden reduction objective in principle, we are concerned that this particular omnibus package with its tight timeline may entail legislative changes with insufficient time for meaningful stakeholder consultation or for learning from the practical implementation.

We are also concerned that well-meaning Commission proposals to simplify administrative requirements for companies in legislation such as the CSRD might lead to major changes to core parts of the law. This could happen during the co-legislative process, when the proposal is discussed and approved by the European Parliament and the Council. If this happens, and as stated in our December 2024 statement on 10 high-level principles for burden reduction, we call on the Commission to consider at what point it might be better to withdraw its proposal altogether.

The CSRD is still being implemented by companies and transposed by Member States. Changing the requirements so swiftly could introduce unnecessary uncertainties, impose additional burdens on companies already working to comply, and undermine trust in EU legislation. Many actors in the reporting ecosystem may reasonably question why they should invest time and resources in preparing for compliance and legislative changes when the EU may revise requirements at the last minute anyway.

However, we acknowledge that the Commission is under significant political pressure to act, that there can be significant potential for simplification within the CSRD, and that its policy objectives could be achieved with fewer burdens on companies. It is also crucially important that the Commission closely monitors Member State implementation, and swiftly addresses instances where national transposition may change the legislation or deviate from EU definitions.

Therefore, if the Commission decides to propose changes to the core legislation, Accountancy Europe provides suggestions below for how this could be done. These suggestions are based on our consistent positions from over the years, and directly build on them.

For example, Accountancy Europe has consistently and over the years raised concerns about the level of granularity in the European Sustainability Reporting Standards (ESRS)[1]. This is not in the least because the governance and due process in developing the ESRS within EFRAG has consistently suffered from certain limitations that we fear may have undermined the potential quality of these standards – something that Accountancy Europe has also consistently raised as a concern[2].

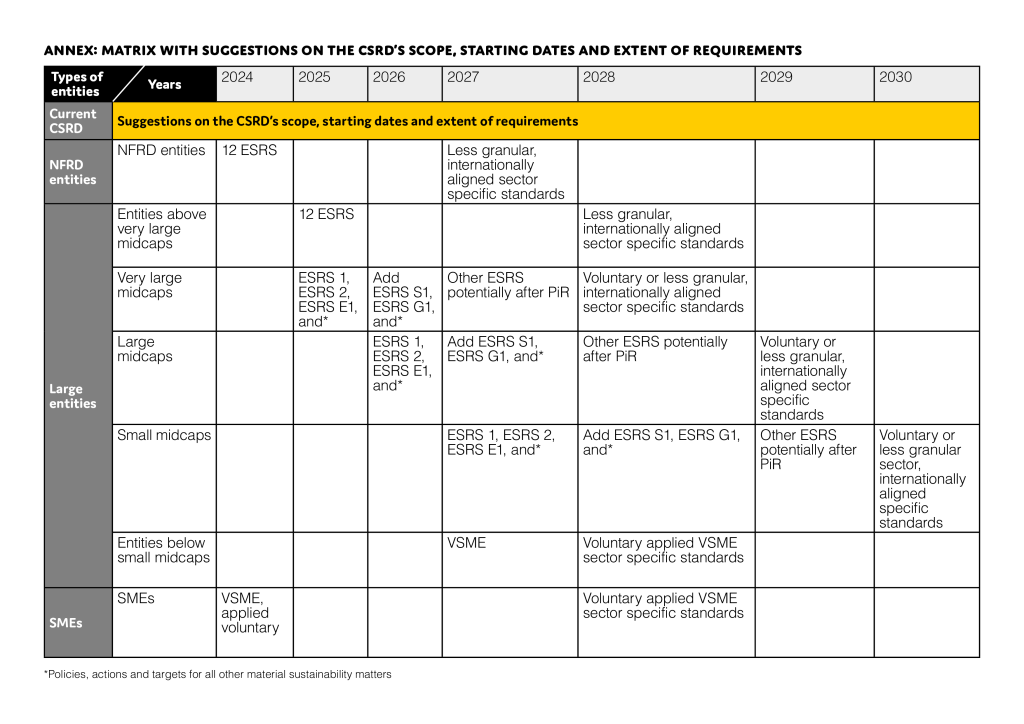

Our below CSRD related suggestions focus on its scope, starting dates and the extent of the reporting requirements. As for the CSDDD and taxonomy, we provide some high-level indications for a possible way forward further below.

Given the current stage of CSRD’s implementation, the Commission must strike a balance between simplifying requirements and preserving the integrity of the legislation, while minimizing disruption to ongoing compliance efforts. To that end, the Commission should focus any alleviations in a possible omnibus proposal on provisions that have not yet been implemented due to their later compliance deadlines, rather than retroactively altering obligations that are already in effect.

This document’s annex provides a table overview of our proposed approach, which helps to better visualise the substance of the recommendations.

The CSRD, which became applicable as from 1 January 2024 (first reports in 2025), introduces significant changes for entities previously covered under the EU Non-Financial Reporting Directive (NFRD). They include publicly listed entities (PIEs), banks, insurance companies, and other entities deemed by national authorities to be ‘public-interest’ with more than 500 employees.

Approximately 12.000 entities previously in the NFRD’s scope (‘NFRD entities’) will be required to report in 2024 under the new ESRS, a set of 284 pages covering 12 sector-agnostic standards, including 1.134 datapoints and 83 disclosure requirements, to be determined based on a double materiality assessment.

In addition to the ‘NFRD entities’, the CSRD and ESRS will become mandatory for approximately 30.000 ‘other EU large entities’ as from 1 January 2025 (first reports in 2026). These entities are those exceeding two of the following three criteria for two consecutive years:

Environmental and social impacts, risks and opportunities are bound to differ starkly between the ‘NFRD entities’, and smaller ‘other large entities’, and especially those at its tail end. Their environmental and societal footprints, as well as their financial and human resources to implement legislation and reporting requirements are likewise very different.

Therefore, we propose that not all ‘other large entities’ as currently defined, should apply the CSRD and the ESRS as from 1 January 2025. The scope of these entities to apply the CSRD and the ESRS, the starting date of their application as well as the granularity of sustainability reporting standards could be amended for a considerable number of these entities.

How to do this best would ideally be based on lessons learnt from a post implementation review of the application of the CSRD and the ESRS by ‘NFRD entities’, but we understand that this may not be very practical given the political pressure on the Commission to act swiftly and the fact that for all the large entities the compliance dates have already kicked in.

Therefore, the Commission could consider introducing the following new categories of small, large and very large midcap companies specifically for CSRD purposes. These categories could be defined for instance based on employee or other size criteria[3]. Accountancy Europe does not propose any specific criteria, as the Commission will be best placed to assess this with Member States.

As a next step, the introduction of mandatory sustainability reporting for each of the new three categories could be staggered. For instance[4]:

In addition, these new categories of companies could be allowed to use a less demanding set of sustainability reporting standards, which can be gradually phased-in if deemed necessary.

For example, the very large midcap companies could start in 2025 just with reporting on General requirements (ESRS 1), General disclosures (ESRS 2) and Climate change (ESRS E1). However, if after the double materiality assessment of impacts, risks and opportunities as per ESRS 1, the company determines further material matters than climate change, then the company should disclose information on policies, actions and targets on these, After the first year, companies would add reporting using Own workforce (ESRS S1) and Business conduct (ESRS G1) as from 2026. Reporting using the remaining 7 ESRS could be added in 2027 if deemed fit-for-purpose on the basis of the first post-implementation reviews (PiR). For large midcap companies starting as from 2026 and small midcap companies starting in 2027, a similar approach should be applied.

At the same time, there may be entities that are not PIEs[5] or fall above the ‘very large midcap’ category, but that are nonetheless expected to have very significant environmental and social impacts similar in scale to the NFRD entities. Such entities should continue to fall under the CSRD and full ESRS as from 1 January 2025.

Some stakeholders and governments have proposed the Listed SME (LSME) sustainability reporting standard as a more simplified version of ESRS for more companies such as mid-caps to use. However, the LSME standard as currently conceived is unfortunately not suitable to be used for mid-cap companies as among other criticisms, it is not adequately designed for consolidated sustainability reports to subsequently qualify for subsidiary exemption and reduce burden for the reporting group.

Finally, companies that are below the small midcap company category but that are still above the EU SME definition could be exempt from direct application of CSRD and ESRS since many of them will eventually, after the transitional provision of 3 years, be part of the value chains of larger entities falling under the CSRD[6]. These entities should be allowed to use the EFRAG Voluntary Reporting Standards for Small & Medium-sized Entities (VSME). Small and Medium-sized Entities (SMEs) would continue to use the VSME voluntarily.

Such a staggered approach will provide more time for policymakers, supervisors and preparers to learn from practice, and be better prepared for sustainability reporting. Delaying reporting requirements for these new sub-categories of entities will also delay sustainability assurance on their reports, which will likewise provide lessons learned for preparers and assurance providers alike.

The CSRD also requires the adoption of sector-specific ESRS by mid-2026 to be able to report sector-specific information starting after the respective delegated act is incorporated in EU law. The main objective of sector standards is to minimize or standardise entity specific disclosures and have better and more comparable information. EFRAG has already started to prepare 35 different sector-specific standards, although none of them have been consulted on or finalised so far. Before any further EFRAG work on these sector-specific standards, as well as other workflows, the concerns raised before around the governance and due process underpinning the development and legitimacy of these standards should be addressed first.

Sector-specific sustainability reporting is not new. For instance, the International Sustainability Standards Board (ISSB) has 77 industry-based standards originally developed by the Sustainability Accounting Standards Board (SASB). The SASB standards have already gone through an internationalisation process and the ISSB is currently working on updating them. Also, the Global Reporting Initiative (GRI) has issued 4 sector-specific standards and plans to develop a total of 40 such standards.

Existing international sector-specific standards are already used by thousands of companies, including in the EU. The ISSB standards, currently progressing towards adoption or other use in many jurisdictions, also refer to SASB when determining material sustainability-related risks and opportunities.

Therefore, in order to reduce burdens and ensure interoperability with other standards, but also to comply with the CSRD’s requirements, the sector-specific ESRS should take into account, to the greatest extent possible, the work of global standard-setting initiatives for sustainability reporting, such as existing standards and classifications. These should form the basis for the EU’s work to develop sector-specific ESRS.

This could start with lessons learnt from a post implementation review of the application of existing international sector-specific standards, in order to determine what really matters in sector-specific sustainability reporting to minimize entity specific disclosures. EFRAG, with the support of the European Commission, should then closely work together with existing international standard setters in an open and constructive way to develop sector-specific ESRS.

Overall, EFRAG and the European Commission together with the international standard setters should strive to reduce unnecessary granularity of sector-specific sustainability reporting standards which primary objective is to minimize entity specific disclosures. In addition to reducing granularity in the sector specific ESRS, the scope of entities that apply them as well as the starting date of their application could also be amended for a considerable number of entities. This could again be on the basis of a staggered approach as proposed in the previous section. [7]

For example, very large midcap companies could, voluntarily, apply sector-specific standards as from 1 January 2028, large midcap companies as from 1 January 2029 and small midcap companies as from 1 January 2030. Alternatively, for all midcap companies the use of sector-specific standards could be made voluntary, with an option to opt-out from them.

As indicated in the previous section, there may be entities that are not PIEs[8] or fall above the ‘very large midcap’ category , but that are nonetheless expected to have very significant environmental and social impacts similar in scale to the NFRD entities. Such entities should be required to apply sector-specific standards as soon as the respective delegated act is adopted as EU law.

Finally, at the other end of the spectrum, ‘other large entities’ beneath the small midcap company category[9], as well as SMEs, could be exempt from applying sector-specific standards in a mandatory way[10] In line with our original idea, these companies could instead use EFRAG’s VSME, and a sector-specific VSME ESRS could be referred to as guidance when providing useful information under that standard.

The Commission should carefully assess the added value of the EU Taxonomy Regulation. For example, according to some affected stakeholders the taxonomy suffers from disproportionate complexity as well as lack of clarity and connectivity with other key areas or frameworks which may hamper its market uptake and objectives.

Although the ideas behind the taxonomy have their merits, its implementation appears problematic. Early indications suggest that its take-up by investors and users is limited. Moreover, the introduction of the CSRD and especially the ESRS seems to at least partly replace and/or duplicate it.

However, the EU taxonomy has been in effect for some years, allowing for the possibility of evaluating its outcomes. Therefore, a retrospective assessment could inform targeted adjustments, ensuring any revisions are evidence-based and effective.

With regard to the CSDDD, some stakeholders have expressed concerns about its potential duplication or inconsistency with the CSRD. However, this appears to be relatively limited as the CSDDD does not introduce reporting requirements in addition to the CSRD.

There are, however, some concepts and terminology across CSDDD and CSRD where the Commission could re-assess their interoperability and whether they should be aligned. For example, this could be the case for “chain of activities” and “value chain”, “sectors” versus “activities”, and approaches to the scope of consolidation in the two texts.

As the new Commission embarks on an ambitious project to alleviate administrative burdens on companies and foster EU’s competitiveness whilst not undermining the policy objectives, additional policy areas and EU legislation may fall under review in the coming years. Accountancy Europe and its members stand ready to contribute to these additional burden reduction efforts as well.

[1] See example: https://accountancyeurope.eu/consultation-response/letter-to-commissioner-mcguinness-on-draft-esrs-issued-by-efrag-ptf-esrs/

[2] See example: https://accountancyeurope.eu/consultation-response/letter-to-the-ec-on-the-efrag-funding-for-the-development-of-credible-and-successful-esrs/

[3] For example, this could be inspired by the current typical EU definitions for mid-cap companies: small mid-caps (250-499 employees), large mid-caps (500-1,499 employees), and very large mid-caps (1,500 employees and beyond). See: https://op.europa.eu/en/publication-detail/-/publication/ad5fdad5-6a33-11ed-b14f-01aa75ed71a1/language-en

[4] See annex for an overview

[5] Whether or not such entities which are not PIEs but are above the ‘very large mid-cap’ category would even exist depends on how the Commission will define the thresholds for a possible very large mid-cap category.

[6] Whether or not such entities above the EU SME definition but below a possible new small mid-cap definition would even exist depends on how the Commission will define the thresholds for a possible small mid-cap category.

[7] See this document’s annex

[8] Whether or not such entities which are not PIEs but are above the ‘very large mid-cap’ category would even exist depends on how the Commission will define the thresholds for a possible very large mid-cap category.

[9] Whether or not such entities above the ‘very large mid-cap’ category but not considered to be ‘NFRD entities’ would even exist depends on how the Commission will define the thresholds for a possible very large mid-cap category

[10] As in the previous section, this will again depend on how the Commission would define small midcaps and whether, in such a case, companies above the EU SME definition and below this new small midcap definition would even exist.