11 September 2024 — Publication

Summary of views from Accountancy Europe

The European Sustainability Reporting Standards (ESRS) have been effective since 1 January 2024 for the first companies in the Corporate Sustainability Reporting Directive’s (CSRD) scope. The ESRS introduce a new reporting framework in Europe and include many new concepts which stakeholders may find challenging. The European Commission (EC) and EFRAG are focusing their efforts on providing implementation support. Accountancy Europe has contributed to every step of the ESRS development and finalisation and has shared suggestions for high-quality ESRS implementation.

Under the CSRD, EFRAG was tasked to provide the EC with technical advice, which includes the draft ESRS accompanied by the related cost-benefit analyses. Such advice must be developed following a proper due process, having public oversight, transparency, If either the Council or the EP object, then the respective institution will need to vote. The Council can object via a Council decision which needs a qualified majority to pass. The EP can object by tabling a motion to the plenary where it needs a majority. If either happens, then the delegated act cannot enter into force. However, if a majority is not reached for the objection proposals of the respective institution, then the delegated act is published in the EU OJ and enters into force. Figure 4 summarises the process the EU institutions follow when adopting delegated acts for the ESRSand sufficient public funding. The EC runs its own processes (see below) and ultimately integrates the ESRS into European Union (EU) legislation via delegated acts1.

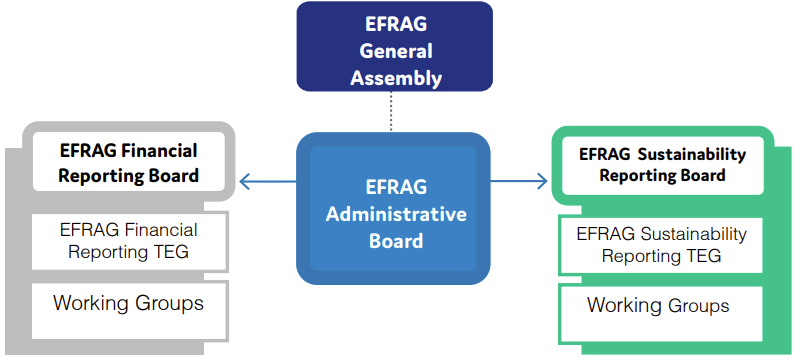

To fulfil its new mandate, EFRAG:

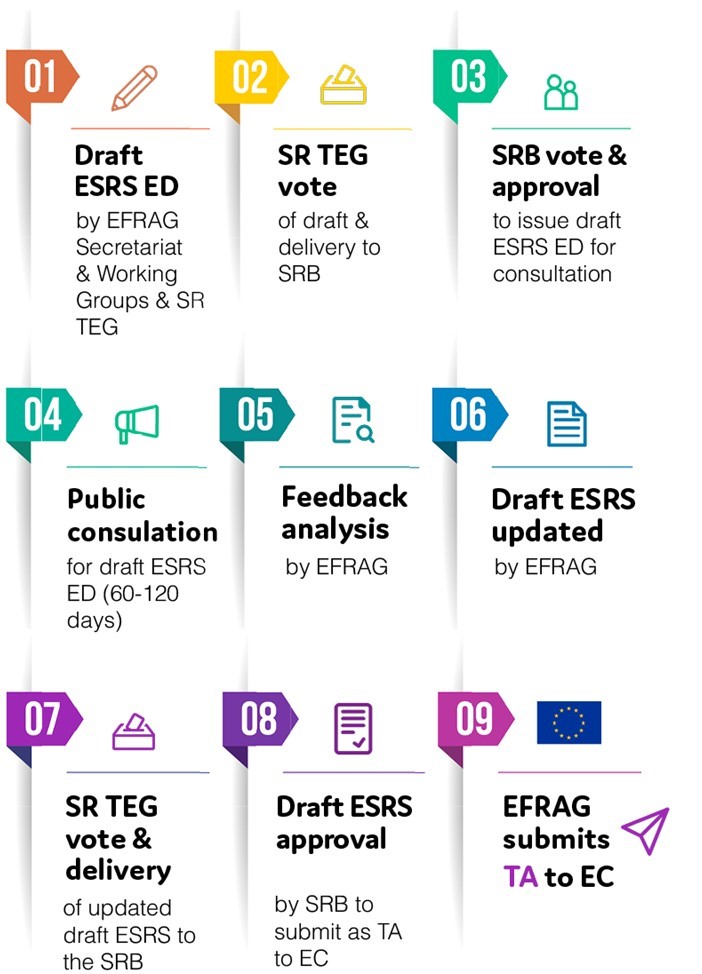

In line with the DPP for SR, Figure 2 summarises the normal procedure from developing the draft ESRS Exposure Draft (ED) to delivering the draft ESRS as technical advice (TA) to the EC.

EFRAG did not follow the first 3 steps of this procedure as its governance reform was underway for the first set of ESRS: the EDs were developed by an informal task force, which also issued them for consultation only for 100 days. The sustainability reporting pillar took over after the consultation and finalised the technical advice on the draft ESRS in four months. EFRAG also outsourced key standard-setting tasks (i.e., the feedback analysis and the cost-benefit analysis) for the first set of draft ESRS due to time pressure to meet the CSRD legal deadline.

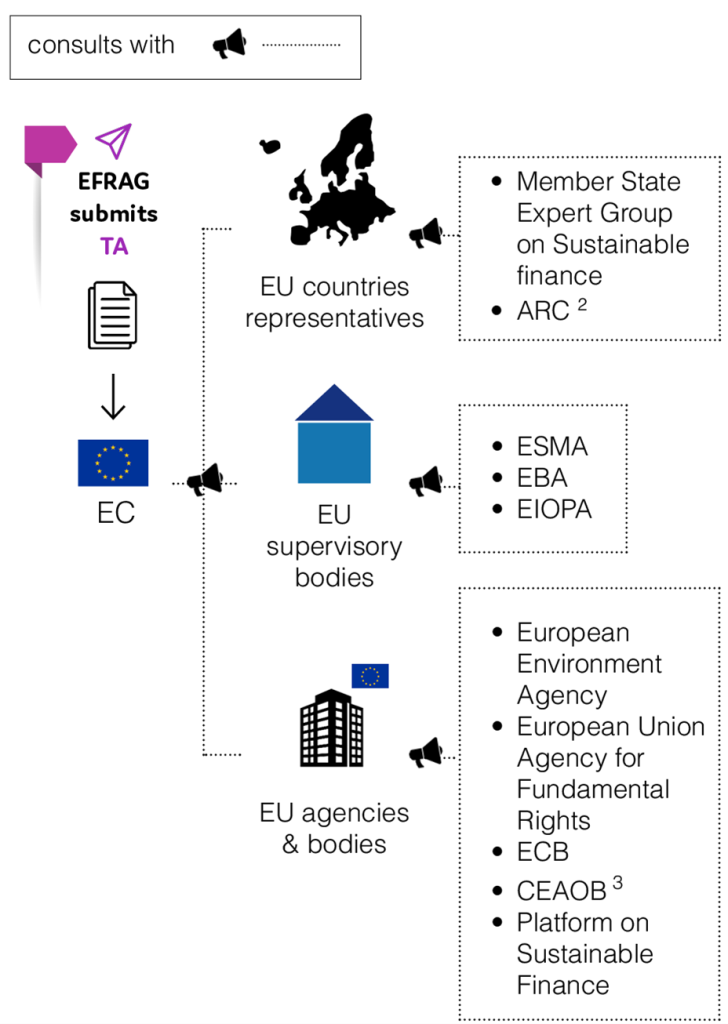

Upon receipt of EFRAG’s technical advice, the CSRD requires the EC to consult on it with several parties (see Figure 323). The EU supervisory bodies, namely, the European Securities and Markets Authority (ESMA), the European Banking Authority (EBA) and the European Insurance and Occupational Pensions Authority (EIOPA) are required to provide an opinion within two months of the EC’s request.

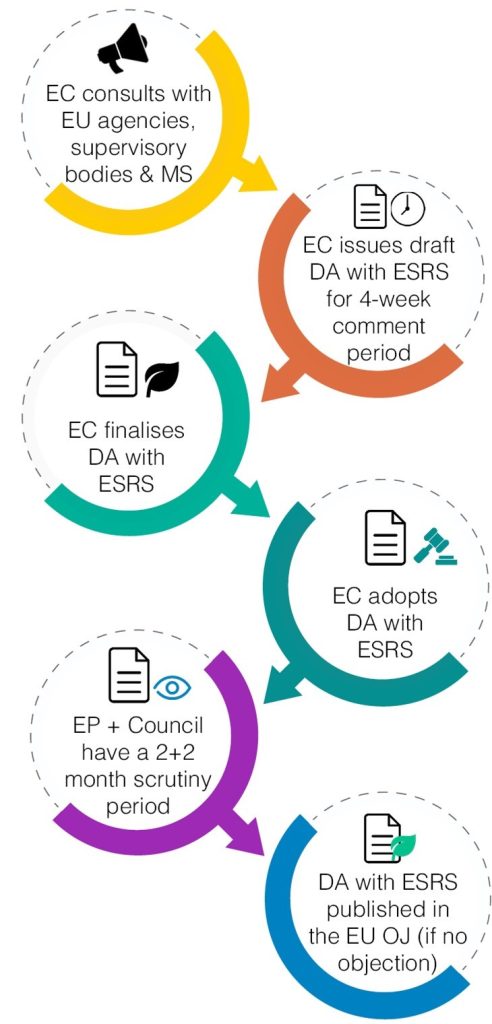

The EC considers the opinions and feedback and publishes the draft delegated act for a four-week period public consultation in line with the Better Regulation agenda.

The EC finally adopts the delegated act having considered stakeholders’ views and submits it to the European Parliament (EP) and the Council. Unless one of them or both object to the delegated act in a two-month period, it enters into force and is published in the European Union Official Journal (EU OJ). The period for objection might be extended by an additional two months if either the Council or the EP request such extension.

If either the Council or the EP object, then the respective institution will need to vote. The Council can object via a Council decision which needs a qualified majority to pass. The EP can object by tabling a motion to the plenary where it needs a majority. If either happens, then the delegated act cannot enter into force. However, if a majority is not reached for the objection proposals of the respective institution, then the delegated act is published in the EU OJ and enters into force. Figure 4 summarises the process the EU institutions follow when adopting delegated acts for the ESRS.

For the first set of ESRS delegated act, some members of the EP tabled a motion for a resolution to object to the ESRS, which did not get a majority vote4, ultimately clearing the ESRS to enter into force.

Upon the EC’s request EFRAG also works on implementation support, digitalisation guidance, interoperability with international standards and frameworks, and developing other standards. The EC also issued questions and answers on the adoption of the ESRS and recently, FAQs on the CSRD, including ESRS.

The table at the end of this document summarises EFRAG’s and the EC’s finalised and ongoing materials and work.

Robust, transparent, clear and independent due processes legitimise standards. It is paramount for EFRAG and the EC to follow a rigorous due process, allow stakeholders the adequate time to respond to consultations and field-test standards before finalisation to ensure the ESRS are fit-for-purpose. In addition, EFRAG should formalise the processes it follows for its additional EC’s requested workstreams (see Annex below).

Accountancy Europe called for adequate public funding for EFRAG to deliver ESRS-related tasks in this joint letter. The EC has assigned EFRAG various tasks in addition to those mandated under the CSRD that in our view require additional, dedicated funding. This would equip EFRAG with the necessary resources to undertake the important ESRS-related work without heavily relying on its members’ in-kind resources, and enable it to follow an adequate due process.

EFRAG provides non-authoritative answers to ESRS-related questions via its Q&A Platform and its Implementation Guidance (see Annex). We suggest EFRAG answers questions only via the Q&A platform, to avoid duplications and for simplicity. For this, EFRAG should move the FAQs in the Implementation Guidance to the Q&A platform deliverables.

The EC too issued non-authoritative FAQs on CSRD, including on ESRS. These include topics already addressed by EFRAG, creating confusion and undermining the usefulness of EFRAG resources. To simplify, the EC and EFRAG could set up a joint ESRS Interpretation Committee, similar to IFRIC, which would provide official and authoritative ESRS interpretations, which would then be incorporated into EU law.

The basis for conclusions, while non-legally binding, are key to understanding the rationale behind the final standards’ provisions and help implementation. For this reason, the EC should update EFRAG’s basis for conclusions on the draft ESRS to include the EC’s rationale when making the final changes to the finalised first set of ESRS. This practice should also continue for future ESRS.

EFRAG’s European Lab facilitated dialogue among stakeholders and encouraged good corporate reporting practices. Reactivating it would provide a hub that would allow stakeholders to share real-life examples, challenges and provide suggestions for improvement among parties in the ESRS reporting ecosystem.

DISCLAIMER: Accountancy Europe makes every effort to ensure, but cannot guarantee, that the information in this publication is accurate and we cannot accept any liability in relation to this information. We encourage dissemination of this publication, if we are acknowledged as the source of the material and there is a hyperlink that refers to our original content. If you would like to reproduce or translate this publication, please send a request to [email protected].

To see the annexes, scroll up and download this publication in PDF.

Published in this series: