The European Commission (EC) launched the Omnibus proposal to revise certain requirements of the Corporate Sustainability Directive (CSRD), Corporate Due Diligence Directive (CSDDD) and EU Taxonomy. The package aims to simplify measures and reduce administrative burden for companies.

Accountancy Europe supports EU efforts to simplify existing requirements to reduce administrative and reporting burdens for EU companies and boost EU competitiveness – simplifying without backtracking on policy goals to transition to a net zero, resource-efficient and competitive economy. We fully recognise that the EU Green Deal encompasses numerous legislative initiatives cutting through different sectors which resulted in an influx of new sustainability linked legislation. Reassessing requirements is an important aspect of good lawmaking, ensuring that only what is necessary remains to achieve underlying policy objectives.

We should remember, however, that the CSRD was proposed to support the EU Green Deal’s goals by ensuring that financial markets and stakeholders have access to consistent, comparable and reliable sustainability information. It serves as a building block for creating a standardised sustainability disclosure regime to support the goals on transparency, accountability and green investment.

As the EU institutions continue the negotiations, Accountancy Europe shares the European accountancy profession’s views on the changes proposed on the CSRD.

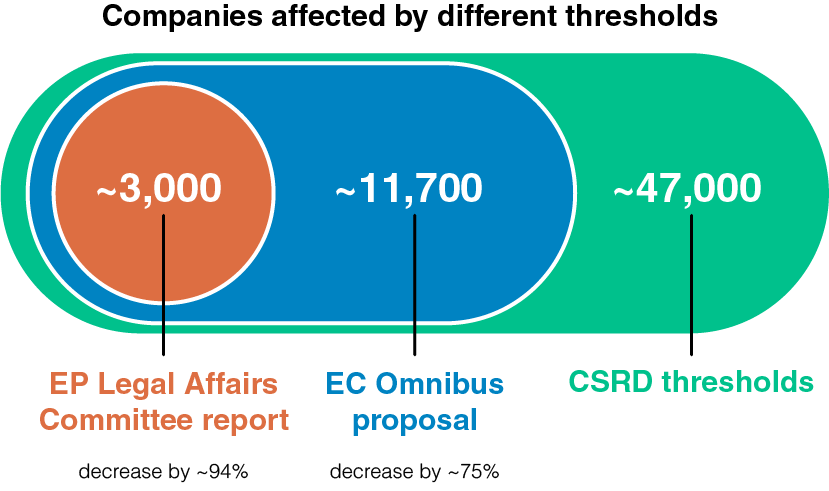

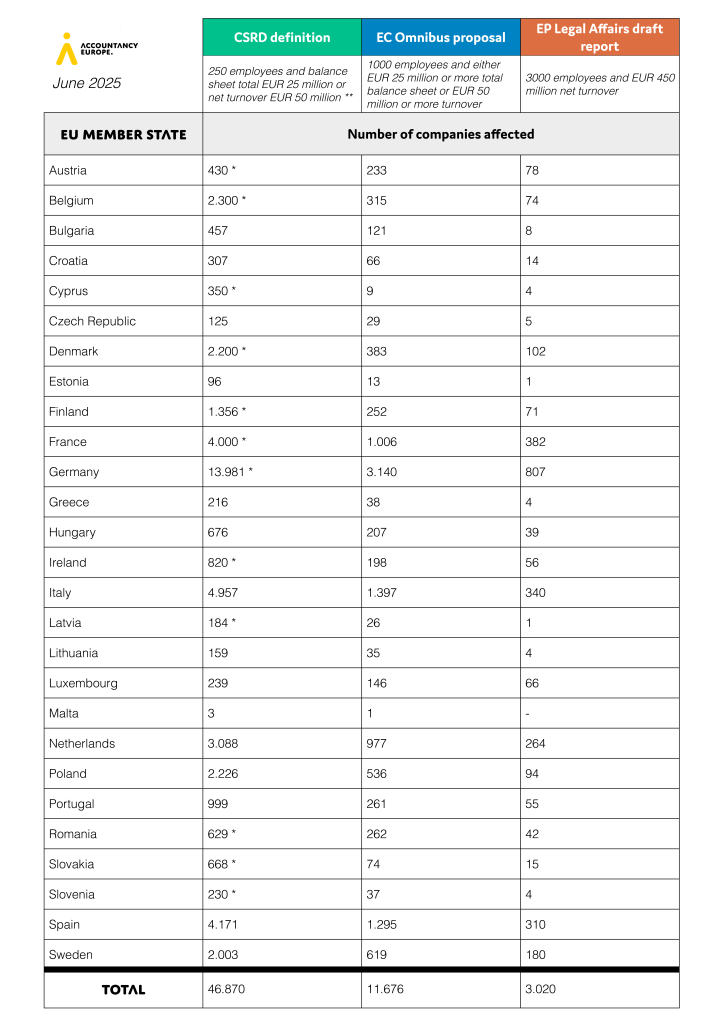

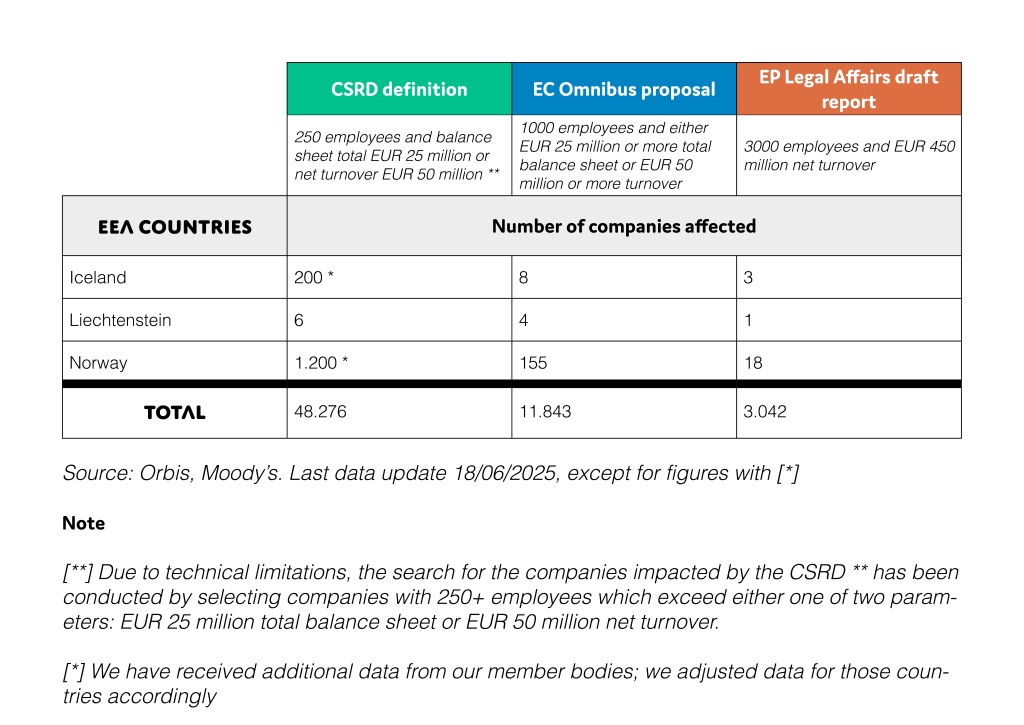

The Omnibus proposal narrows the scope of companies that would have to comply with the CSRD requirements. The EC proposed to capture only the largest companies with more than 1.000 employees on average and either exceeding € 25 million total on balance sheet or € 50 million turnover. According to the EC, the CSRD covered 42.500 companies. The Omnibus proposed changes would reduce the number of impacted companies by 80%.

The European Parliament (EP) Legal Affairs Committee lead negotiator MEP Jörgen Warborn (EPP/Sweden) suggested to raise the thresholds to 3.000 employees and EUR 450 million net turnover driving the numbers of companies covered ever lower.

Accountancy Europe gathered insights on the number of companies across Europe and how different thresholds would impact those numbers. This data is based on the Orbis, Moody’s database estimations and Accountancy Europe member bodies provided information – please see the table below for further explanation on limitations.

According to data gathered by Accountancy Europe:

It is important to highlight that such thresholds would mean that 1/3 of EU Member States would have less than 10 companies subject to the CSRD potentially leading to less available data necessary for industrial transformation of the EU economy.

It is important to consider whether the proposed changes will achieve the intended goal – simplify and reduce administrative burden for companies while still ensuring the EU’s transition to a sustainable economy. We fear that the proposed changes to thresholds might undermine the objective of transforming the EU into a net-zero, resource efficient and competitive economy.

Sustainability data is crucial to manage risks and develop resilience strategies centred on low-carbon and circular business models which are key drivers of transition and competitiveness. Corporate sustainability reporting provides insights that can be integrated into a company’s management systems to uncover new opportunities and improve overall performance.

Companies with 500–1.000 employees make up a significant portion of the EU economy and are often part of the value chains of larger firms. Limiting the CSRD scope to companies with more than 1.000 employees – let alone 3.000, would drastically reduce the availability of information on companies’ sustainability performance and financial risks stemming from sustainability developments. This data is critical to mobilise capital for sustainable transition. This could also hinder companies’ ability to access capital from the market or public financing opportunities.

Besides, we would like to note that focusing mainly on the headcount might not be a justified approach for promoting sustainable practice. Defining company size based primarily on the number of employees deviates from the commonly used criteria: two of the following three thresholds: turnover, balance sheet total, and number of employees. Service sector companies often have higher employee numbers, while large industrial firms with significant environmental impact may have relatively few employees. As such, employee count alone may not accurately reflect a company’s scale or sustainability impact.

Besides, the European Sustainability Reporting Standards (ESRS) are currently undergoing a revision to simplify and significantly reduce the granularity of reporting requirements for companies[1]. EFRAG, that the EC mandated to revise the ESRS, indicates that it is activating six key levers to reach 50+ percent reduction of mandatory datapoints [update of 20 June 2025]. The output is meant to achieve significant simplification for companies to disclose sustainability information which should be taken into account in the negotiations.

The CSRD laid fundamentals for the EU’s sustainable finance framework (EU Taxonomy, EU Green Bonds, Sustainable Finance Disclosure Regulation (SFDR), …), serving as a building block for a standardised sustainability disclosure regime to support the goals on transparency, accountability and green investment. By mandating consistent, comparable, and reliable sustainability disclosures, the CSRD provides financial market participants with the needed data to assess environmental, social, and governance (ESG) risks and opportunities. As we note before, the exclusion of mid-size category (500-1000 employees) companies might result in data gaps and hinder the financial market participants ability to comply with their own requirements stemming from legislative initiatives such as the SFDR. Investors’ representatives[2] raised concerns that the proposed changes could weaken EU sustainability disclosures, harming investments and economic competitiveness.

These numbers are estimates. The database relies on the information submitted by companies. As of the time of writing (June 2025), the database may not yet contain complete information for the 2024 financial year – data has been compiled based on the latest available financial reports.

Due to technical limitations, the search for the companies impacted by the CSRD ** has been conducted by selecting companies with 250+ employees which exceed either one of two parameters: EUR 25 million total balance sheet or EUR 50 million net turnover

We have received additional data from our member bodies; we adjusted data for those countries accordingly *

This data was sourced from a database that includes only companies required to file their financial statements with a national repository. As not all countries mandate the public disclosure of financial statements with a national repository, data for certain countries may be understated, as they are based on voluntary filings only.

[1] Accountancy Europe’s Omnibus statement: ESRS revision proposals https://accountancyeurope.eu/news/accountancy-europes-omnibus-statement-esrs-revision-proposals/

[2] See statements on scope by EFAMA, Eurosif, UN PRI, Joint statement Eurosif, IIGCC, the PRI