31 May 2021 — News

by Cyril Degrilart from CNCC and CSOEC France

Cyril Degrilart is a chartered accountant in Paris. He is an active member of our SME and Young Professional (YP) Networks, where he represents the French Institute of Statutory Auditors and the Order of Certified Accountants. He reflects upon SME digitalisation and young accountants’ role in shaping the future of the profession.

Cyril will be sharing his insights on how accountants can help SMEs in the path towards digitalisation in our 16 June webinar Road to digital: How to support SMEs. Register now!

I started my own accounting practice in Paris after graduation with one question in mind: how to ensure that SMEs get the same quality of advice as do larger companies? As a young accountant, the answer was almost self-evident to me – making the most of technology and putting it to the service of our SME clients.

Today, we are a 5-member team in a digitalised and connected practice. One of the key services we provide is organisational consulting to SMEs, especially for e-businesses and service companies. Our end goal is to help smaller businesses build their strategy more efficiently.

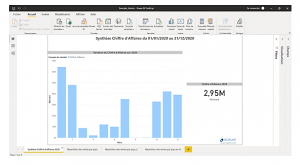

Accrual accounting can be extremely relevant for SMEs, especially in solvency analysis, linked with a precise cash forecast analysis. We analyse our clients’ data such as profit and loss, cash forecasts and solvency, and then transform and visualise them into understandable, user-friendly information. Making numbers more meaningful and accessible for SMEs is key for them to make better business decisions.

Data analysis and visualisation should become mainstream instruments for all accounting practices. To set up a business strategy, SMEs need smart and comprehensible key performance indicators (KPIs). We analyse their data and then communicate KPIs through graphs and visuals. These tools allow SMEs to better understand their performance, access up-to-date information about their business and improve decision-making. Digitalisation and cutting-edge technologies truly help SMEs manage their own business more effectively.

The Covid crisis has emphasised the need for SMEs to digitalise. For example, by reinforcing internal procedures and controls to secure financial processes and limit risks, helping businesses go from offline to online, implementing new ways to record cash flow, advising on e-business VAT. These actions are part of an e-business strategy connected to our accounting role.

The Covid crisis has emphasised the need for SMEs to digitalise. For example, by reinforcing internal procedures and controls to secure financial processes and limit risks, helping businesses go from offline to online, implementing new ways to record cash flow, advising on e-business VAT. These actions are part of an e-business strategy connected to our accounting role.

The YP network is a wonderful platform that gives a voice to young European accountants. It is a unique opportunity to share best practices with my fellow European colleagues. We compare experiences to learn from each other, which is needed to stimulate innovation. We are looking forward to providing our expertise to shape the future of the profession.