4 June 2025 — Publication

Trends and insights in European markets

Accountancy Europe’s information paper explores the evolution and impact of private equity (PE) investment in the European accountancy profession over the last decade. Based on publicly available data and case studies, it provides a neutral, fact-based overview of key developments, investment strategies, and market trends from 2015 to 2025.

Read the full publication here

Traditionally, accountancy firms grew through organic expansion, long-term client relationships, and partner-driven governance models. However, rapid technological change, increasing competition, and the need to scale services have made external investment more attractive. PE firms, in turn, have recognised the accountancy sector as an appealing investment opportunity, given its stable cash flows, recurring revenues, and growth potential.

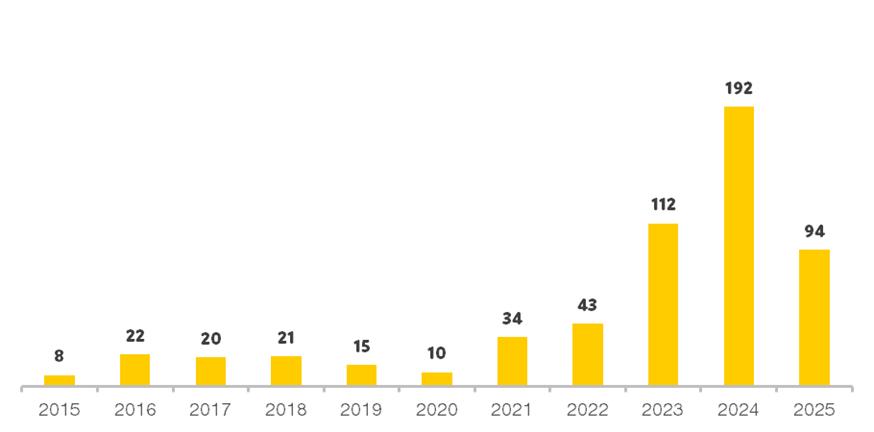

The trend, which began in the United States, has gained significant momentum in Europe—particularly from 2023 onward. PE activity in the sector increased from a modest 10–20 deals annually before 2022 to over 100 transactions in 2023 and approximately 200 in 2024.

The paper outlines several PE investment models used in the profession:

While PE interest is growing across the accountancy sector, regulatory constraints make it more difficult for PE firms to invest in audit practices. EU rules require audit firms to be majority-owned and controlled by qualified statutory auditors. As a result, about 60% of PE deals have targeted accounting, tax, and advisory firms, while 40% involve firms with audit and assurance services.

Nonetheless, PE investment in audit firms has tripled in 2023 and quadrupled in 2024, indicating a growing interest despite legal hurdles.

PE activity has been concentrated in several key European markets:

PE investment in the accountancy sector is no longer a niche trend but a growing part of the European professional services landscape. As consolidation accelerates and digitalisation reshapes business models, PE firms are likely to continue playing a significant role, especially in markets with fragmented firm structures and a strong SME focus.

Accountancy Europe will continue monitoring developments in this area and considers exploring:

Read the full publication in the Download section.