27 November 2025 — Publication

Risks and opportunities

Read the full paper here.

This paper explores how third-party ownership, including Private Equity (PE), is reshaping the European accountancy and audit sector. Building on Accountancy Europe’s June 2025 publication on private equity investments, it analyses the broader landscape of external capital participation.

This publication analyses and highlight both risks (such as on quality, independence, governance) and opportunities (including innovation, investment and growth). It also examines the motivations driving third-party ownership investors to enter the accountancy and audit market, and why parts of the profession are increasingly open to this evolution.

Historically, most accountancy firms were partnerships owned and managed by practicing professionals. This ensured accountability and independence. As firms grew, many formed international networks, legally separate entities bound by shared standards and brands.

Following corporate scandals in the early 2000s, the EU introduced the Statutory Audit Directive 2006/43/EC, requiring that a majority of voting rights in audit firms be held by approved statutory auditors. The 2014 reform package (Directive 2014/56/EU and Regulation 2014/537/EU) reinforced this principle, preserving auditor-majority control to maintain independence and public confidence.

Approximately 100 PE transactions in the European accountancy sector were recorded in 2023, doubling to 200 in 2024. While 60% of these involved non-audit firms, the remaining 40% included audit services.

Several models of third-party ownership are now present in the accountancy and audit profession:

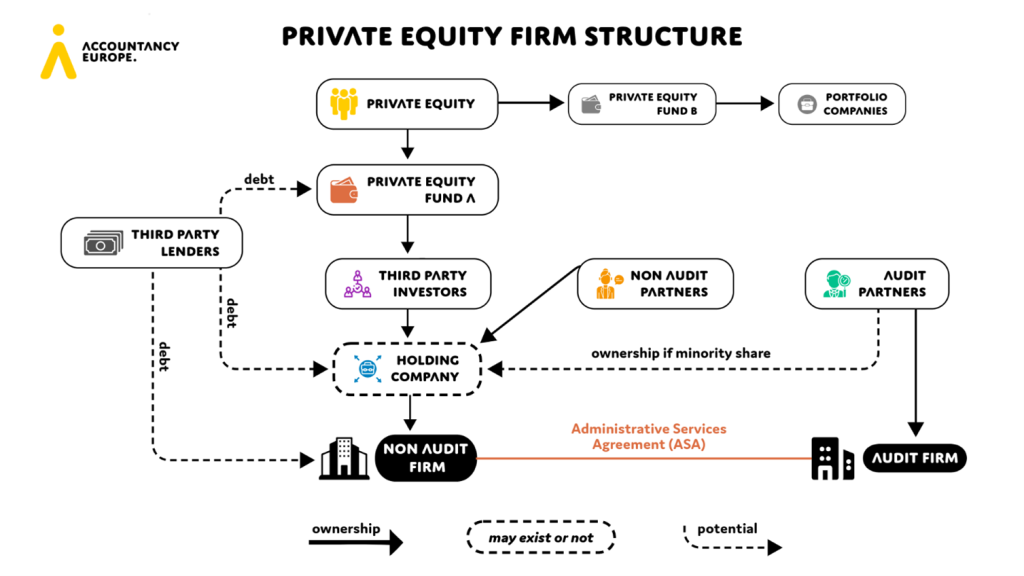

A third-party investor or PE fund ordinarily invests in an accountancy and audit firm that undergoes legal restructuring into two distinct entities: an audit firm and a non-audit firm. The non-audit firm usually provides professional services and resources to the audit firm under an ASA.

PE structures often include holding companies, which may vary depending on ownership levels. When a PE holds a minority stake, audit partners can participate in the holding company. However, when PE ownership exceeds 50%, EU and UK rules require statutory audit firms to remain controlled by qualified auditors, meaning the audit firm must sit outside the PE-controlled structure.

ASAs allow PE-owned non-audit entities to provide centralised support services while keeping audit functions separate, though questions remain about whether these agreements always protect independence effectively. Independence requirements under the IESBA Code apply to both audit and non-audit entities within the same network.

Regarding anti-money laundering (AML), PE firms are subject to obligations only when they qualify as obliged entities. Beneficial ownership disclosure rules apply to all EU legal entities, including PE structures, ensuring transparency.

Accountancy firms attract third-party investors due to:

From the firms’ perspective, engaging with external investors offers:

Despite these risks, third-party ownership also offers significant opportunities for the profession:

Third-party ownership is reshaping the accountancy and audit sector. While it brings both promise and risk, its continued growth calls for thoughtful dialogue between policymakers, regulators, the profession and its owners-investors. Accountancy Europe does not advocate for or against such ownership but seeks to promote informed debate grounded in evidence and transparency.

The profession must ensure that, independence, and quality continue to serve the public interest. This publication forms part of Accountancy Europe’s ongoing work to monitor third party ownership developments and foster discussion on how the profession can evolve responsibly in a changing market.

Download the full paper here.